This is according to Ministry of Finance’s data presented to Parliament earlier this week.

New Delhi: More than 8,500 wilful defaulters together owe Indian banks more than Rs two lakh fifty-eight thousand crore as on 31 March this year, according to Ministry of Finance’s data presented to the Parliament earlier this week. According to the Ministry, the financial year 2014-15 saw the highest number of wilful defaulters being identified in the country, following which the number of such persons started to fall. Last financial year (2020-21), some 1,063 wilful defaulters were identified by various banks in India.

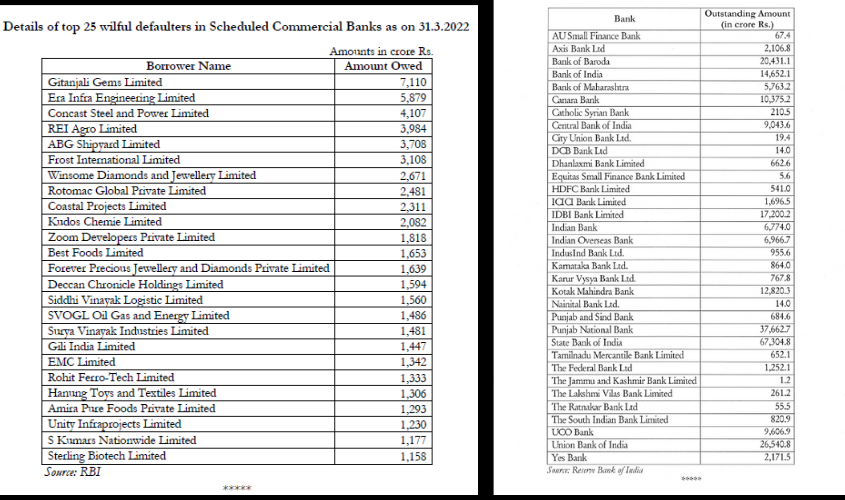

Wilful defaulters or entities are such persons who have failed or defaulted to repay their borrowing amount despite having the capacity to repay the amount or they have diverted the borrowed amount for purposes specified while availing the amount or have siphoned off funds or disposed of or removed secured assets without the bank’s knowledge. The Ministry also published a list of top 25 wilful defaulters of the country. The largest wilful defaulter is the Mehul Choksi owned Gitanjali Gems Limited that defrauded banks of Rs 7,110 crore, this is followed by Era Infra Engineering Limited that defrauded banks of over Rs 5,500 crore. This company is registered in Delhi’s New Ashok Nagar and is still under “Active” status with the Registrar of Companies. This company was formed in 1990 and currently has three directors–Mast Ram Chechi, Ratan Lal and Hem Singh Bharana. Bharana is also director of 11 other companies, most of which deal with highway projects and energy transmission.

The third from the top wilful defaulters list—Concast Steel and Power Limited—owes more than Rs 4,000 crore to multiple banks. The 27-year-old company is registered in Kolkata and “Active”. This company has four directors who are also directors in multiple other companies that engage in construction, export, steel, home construction amongst many other such activities.

The other wilful defaulters include ABG Shipyard Limited, Rei Agro Limited, Winsome Diamonds and Jewellery Limited, Rotomac Global Private Limited, that engages in wholesale of household goods and defrauded banks of over Rs 2,400 crore from banks, Zoom Developers Private Limited, the Hyderabad-based Deccan Chronicle Holdings Limited involved in printing, publishing, etc owes more than Rs 1,500 crore, among many others.

Finance Ministry officials said that the reasons for the huge number of NPAs (Non-Performing Assets) and wilful defaulters reported by banks to the RBI was due to an “aggressive” lending procedure that was taken up by the banks during the period between 2008 to 2014. “During this period, banks were engaged in aggressive lending and were giving loans left right and centre without even having 30% collateral of the amount that banks were disbursing to individuals. And just five years from then, banks started to witness non-payments and erratic payments by hundreds of people who had taken hundreds of crores as loans from the bank. This was the time when the bubble of the banks burst,” a former Ministry of Finance official told The Sunday Guardian.

The Ministry also told the Parliament earlier this week that similar were the reasons for the huge number of wilful defaulters in the country. It said that according to the RBI inputs “aggregate gross advances of Scheduled Commercial Banks increased from Rs 25,03,431 crore as on 31.03.2008 to Rs 68,75,748 crore as on 31.3.2014”.

It further added that the asset quality review initiated in 2015 for clean and provisional bank balance sheets revealed the high incidence of NPAs, which increased the higher revelations of wilful defaulters. Some of the banks which have been most affected by this NPA and wilful defaulters are State Bank of India, Punjab National Bank, Bank of Baroda, Union Bank of India, IDBI Bank, Kotak Mahindra Bank, Bank of India, among others.