Yet another stock exchange in Mumbai, the MSEI (Metropolitan Stock Exchange of India), finds itself in choppy waters.

Apart from the reality of no revival of its business for several years, a scheme of the exchange to promote its currency derivatives has come under the scanner of the Central Bureau of Investigations (CBI).

According to documents available with The Sunday Guardian, together with information from highly placed sources, the CBI has initiated a preliminary inquiry in the matter of “unauthorised utilisation of MSEI funds for market making scheme in the currency derivatives segment and non-adherence of standard operating procedures (SOP) while making payments to vendors/stock brokers.” Those close to the exchange deny that any impropriety took place, a version challenged by those investigating the issue. Market watchers are clear that a full probe is needed to get the true picture.

In 2022, the MSEI was eager to avoid closure due to fast depleting net worth, and hence sought a merger with its cash-rich clearing and settlement arm MCCIL. It was unprecedented in India’s exchange space to witness an exchange and its clearing arm merging with each other.

MSEI, earlier known as MCX Stock Exchange (MCX-SX), is the same exchange that once gave the National Stock Exchange (NSE) a run for its money in the currency derivatives segment in 2008. It had emerged as a leader in the space briefly when a Mumbai businessman was its promoter. After regulatory authorities ensured the ouster of Jignesh Shah, the concerned businessman, from India’s exchange space, MCX-SX was later rechristened as MSEI. The renamed entity, however, fell behind in the race with NSE. Successive management teams at the exchange and its board could not succeed in taking on the might of NSE. They could not chalk out a business plan to compete effectively with an exchange that had strong support from influential leaders during the UPA period.

Among other aspects under the scanner of market analysts, they are surprised that MSEI has apparently failed to vigorously follow up a case that would lead it to extract Rs 850 crore (plus interest for more than 10 years) from the NSE. Under Shah, MCX-SX had dragged the NSE to the Competition Commission of India (CCI) for predatory pricing, and had won a reward worth around Rs 850 crore. But the case now hangs in the balance in the Supreme Court on appeal from the NSE. Court watchers claim that MSEI has thus far failed to aggressively pursue the case, which the exchange denies. The Hindu Business Line newspaper had reported in 2021 after MSEI’s current MD joined the exchange that a whistle-blower had told SEBI that MSEI was delaying the resolution of the case in the Supreme Court by not submitting vital documents, thereby causing a loss to the exchange and its shareholders. The MD, Ms Kundu had defended herself by stating that “the case was her top priority. (The) Exchange is pursuing it and all relevant materials have been made available to the legal counsel. However, the case being sub-judice, we cannot comment further.” It has been two years since then and the case has not seen much progress despite its importance to the financial future of the exchange.

In the past few years, the MSEI has seen its net worth deplete to a level that market analysts warned that its regulatory status and existence was threatened. This was the situation until it reportedly decided on a merger with its clearing corporation MSCCIL. As per a report from the Hindu Business Line, the public interest directors (PIDs) of MSCCIL, Rita Menon, a former IAS officer, and Alok Mittal, a long-standing chartered accountant, quit the board in September 2022 to register their protest against the merger. Both are known and respected for their competence.

“My reasons for quitting MCCL are in black and white. It is definitely a set of peculiar circumstances, in which one feels better to resign. To our (board’s) mind a stock exchange and clearing corporation do not merge. We were very clear that there are too many failings within MSEI and it [merger] is really to cover them up and avail the capital of MCCL, which we guarded all these years. MCCL had no big losses. We don’t think MSEI was well run and hence there was no point in putting good money after bad money. We asked MSEI for a rationale and most importantly, a business plan,” IAS officer Menon had told Business Line.

Currently, a CBI letter dated 11 April 2023 in possession of The Sunday Guardian, shows that the Bureau has called for the production of several documents from various entities on 17 April 2023 with regard to the scheme for the period between 2016 to 2019. Sources in the CBI told The Sunday Guardian that the Bureau is likely to widen the scope of its investigations up to 2022. CBI inquiry stems chiefly from observations in the forensic audit, which was ordered by SEBI as it is known that Sebi asks exchanges to get forensic audit conducted by third party auditors. In this case it was E&Y.

Prior to the current CBI inquiry, in September 2022, SEBI had also issued a show cause notice to MSEI officials based on the points mentioned in the forensic audit report, sources said.

As per a letter dated 13 October 2021 written by then Minister of State for Finance Pankaj Chaudary, MSEI was asked to conduct a forensic audit by SEBI to cover “non-compliance of SOP in awarding big ticket contracts including contracts awarded to UTrade.”

The letter further details that the purpose of forensic audit included “cost implications in the delay in shifting of premises, aspects related to net-worth of MSEI, mis-use of facilities and perks by MD (Latika Kundu) and others in senior management, non adherence to SOP while appointing employees, misuse of perks by MD and other management including Saket Bhansali, Sushil Limburkar, manipulation of minutes of board meeting, allegations regarding rights issue in 2018 among other things.” Sources close to these individuals refute any charge of any such behaviour on their part. Clearly, only a comprehensive inquiry will determine which side is in the right, and market watchers say that this needs to be done to ensure confidence in India’s exchange regulators during a period when the country led by Prime Minister Narendra Modi is seeking to replace China as the destination of choice for international investors.

MoS Shri Pankaj Chaudary had revealed that SEBI had already initiated a forensic audit of the exchange by Ernst & Young and that the Ministry of Corporate Affairs was inspecting the books and accounts of MSEI and other related companies under Section 206(5) of the Companies Act.

The whistleblower had alleged to SEBI that MSEI was functioning for the past several months, even after its net worth fell below the minimum regulatory requirement of Rs 100 crore. The whistleblower letters, some of which are also in the possession of The Sunday Guardian, were made by a group of minority shareholders to SEBI and Ministry of Corporate Affairs (MCA), and alleged several governance related lapses.

In August 2021, Business Line had reported that SEBI had ordered a forensic audit into the workings of MSEI on allegations of mismanagement and financial irregularities. The audit was ordered after a whistleblower and shareholders of the exchange sought scrutiny on several aspects including the money allegedly spent by MSEI, fearing the exchange was fast eroding its net worth that could soon fall below the regulatory requirement of Rs 100 crore.

MSEI’s current management has often put the blame on disgruntled ex-employees of the exchange who they claim are engaged in defaming the exchange by talking and writing against it. Market analysts however point out that it has so far failed to justify its lack of revival of business. There is a lack of clarity from the exchange side as to why senior IAS officers such as Ms Menon, who was senior to former SEBI chairman Ajay Tyagi in service, left on a bitter note and after questioning the management. Given that the PMO has also been furnished with particulars of the charges in the context of Prime Minister Modi’s consistent policy of Zero Tolerance towards dubious actions, it is expected by global market watchers that the CBI and other investigating agencies will ascertain the facts without any of the delays that have been commonplace in some earlier inquiries. Doing so would boost international confidence in the integrity of stock markets in India and the efficiency of regulatory authorities. The MSEI imbroglio is being closely watched by international financial entities engaged in the process of determining the ranking of the Indian exchange space on matters of transparency and integrity. In an era of de-coupling from authoritarian states towards democracies, India may be entering a bright spot, once long pending issues get cleared up and the exchange space gets cleaned up in the manner sought by the PMO.

Apart from blaming the disgruntled ex-employees in defaming the exchange and spreading rumours, MSEI recently wrote to a few media houses informing them that it was not aware of any letter, notice or any other communication from the CBI. MSEI has said that all the allegations levelled against the exchange and the management were misleading, reckless and related to past issues pertaining from 2018, which were being regurgitated. That this was nothing but an attempt to sensationalise the matter. According to sources close to the exchange, MSEI has defended itself by stating they were not in receipt of any show cause notice on misuse of funds or rupture of corporate governance and alleged unethical practices and irregularities involving the current exchange management. Their claim is that those following these stories were attempting to malign their reputation and hamper the smooth functioning of the exchange by media trial.

MSEI REPLIES

Please refer to the discussion we had and basis your advise, please see our response on news item published on your site “sundayguardianlive.com” on April 29, 2023 at 7.50 pm titled ‘CBI opens investigations into suspected misuse of MSEI funds’ about our company, Metropolitan Stock Exchange of India Limited (MSE). At the outset, we are shocked and surprised to note that you have unilaterally chosen to run a story. The Article is manifestly motivated with malice so as to calculatedly cause irretrievable harm and damage to the reputation and goodwill of MSEI. The contents of the story are entirely false, baseless and unsubstantiated.

We note that you have chosen to run the said story without verifying with us or even inviting our comments. Secondly, the author of the story has without basis, casted the aspersion on the Management of MSE which is not only unfair but unsubstantiated. The story is therefore a clear form of yellow journalism and click bait. While we are not aware of your alleged sources, it is evident that the story clearly motivated with malice. Serious accusations are being published unnamed sources while hiding behind a tag of ‘special correspondent’. Surprisingly, and in complete deviation from general practices, the article seems to suggest that the article is written at the behest of sources in the Hindu Businessline. The story clearly carry forwards an agenda of group of people including former disgruntled employees to derail the smooth operations of the institution which is working hard to build the business.

The competition matter with NSE and our merger application is sub-judice. We are therefore surprised to note that you’ve sought question the very process which is ongoing before the Courts. The story also covers the matter on MCCIL, our subsidiary and their past directors. We fail to understand your motives to run a one side of story. Evidently and perhaps conveniently, you have failed to consider the press release issued by the Exchange on September 7, 2022. In any event

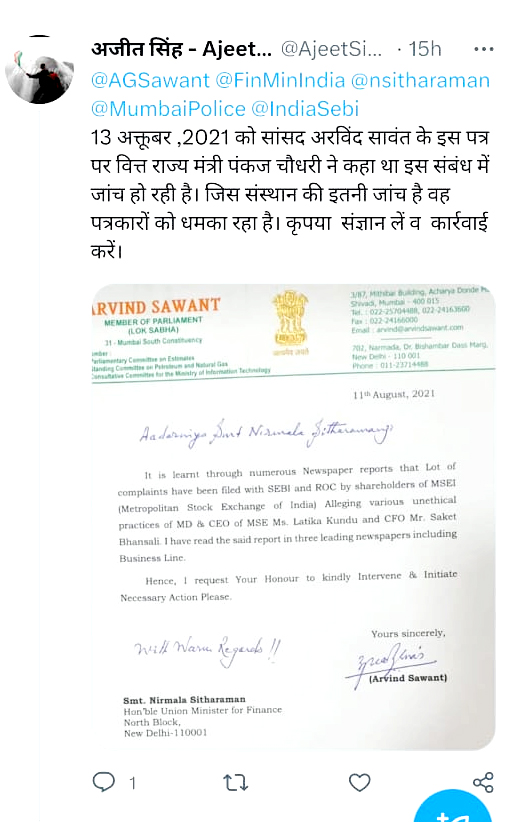

The story also refers to a tweet of one Mr. Ajeet Singh who often uses various platforms to reach out to MSE. While the Exchange has, in order to safeguard its interest written appropriately to Mr. Singh, there appears to be absolutely no justification on your part to refer to the said tweet of Mr. Singh, without verifying the contents therein. It is astonishing that the article consists of a litany of unnamed sources including ones close to the exchange, it is specifically pointed out that the exchange or its officials have not been sought out for their version of the facts being presented. Please note that the author of the article has made a sorry attempt at mixing various alleged issues in order to present a one sided story in complete defiance of the basic tenets of journalism.

Further, the story seems to rely on stories carried in the Hindu Businessline and publishes responses that we have sent to other media houses. Notably, considering the said responses, the media houses have correctly chosen not to publish the story that you have chosen to publish. It is surprising that a reputed publisher like you also chooses to rely on a tweet carried by a journalist who is not on your rolls. This further lends credence to our suspicion that this is a mere attempt by group of people including past disgruntled employees and others to cause substantial distraction of the management and derail the smooth working of the institution. Your good office and your publication is being misused by such miscreants.

You also claim to have CBI letter dated April 11, 2023 in your possession issued to MSE. The story also suggests that your sources in CBI have informed you that they are expanding the scope of investigation till 2022. While we question the very basis of your several claims made in this regard, you seem to have overlooked that you’ve sought to breach the confidential process of CBI investigation in your zeal to publish a click bait story. Please also note, we have received no such letter from the CBI.

The fact that story is nothing but a mudslinging attempt is clear from the fact that issue prior to FY 2018-19 that have been adjudicated upon are being regurgitated now.

The story is therefore not only an instance of a most vicious form of yellow journalism, but case of extreme recklessness, gross and irresponsible reporting and journalism. The same are grossly defamatory of MSEI. All norms of responsible journalism have been sacrificed, in pursuit of reckless sensationalism. You have been reckless and malicious in writing and publishing the same. The story, by itself, and in context of when read as a whole are totally false and per se defamatory and constitutes a serious libel. It contain clear innuendo, which are defamatory. You are therefore hereby called upon to forthwith:

a. Cease and desist from issuing same and/or similar story in any form whatsoever;

b. Remove the story from all online platforms immediately

Thanks and regards,

Legal Department

METROPOLITAN STOCK EXCHANGE OF INDIA LIMITED

Mumbai