Xu Jiayin, the owner of Evergrande is alleged to be close to the Shanghai clique. The Shanghai clique allegedly controls the financial sector in mainland and Hong Kong, of which Xi Jinping has been very wary of.

In my last column, while analysing Li Guangman’s highly publicised article entitled “Everyone can feel that a profound transformation is underway”, I had argued that “the real estate sector, which was one of the pillars to place China’s economic growth on a solid trajectory, is riddled with problems. Though the sector accounts for around 14% of the national GDP, however, also has maximum bad debts amounting to US$7.7 trillion. The nonperforming loans have reached a whopping 30% across the five largest banks of China.” The Evergrande (恒大) crisis is just a tip of the iceberg. The real estate giant owes US$305 billion in debts, more than US$6 billion in insolvent investment portfolios collected from its over 200,000 employees, and has around 800 under construction residential projects. Besides, the conglomerate also owes money to around 1.5 million customers, some of whom have been protesting against the giant across China. There is speculation that the Evergrande crisis is China’s Lehman Brothers moment. Will the Chinese government save the conglomerate or let it go bust? Is China heading and also leading the world towards an economic crisis?

China’s real estate bubble has been around for quite some time. With the massive urbanisation drive in the reform period, property prices rocketed in big cities. No wonder, more than 70% of urban China’s wealth is parked in real estate. However, the “real estate bubble” (房地产泡沫), according to He Keng, deputy director of the Finance and Economics Committee of the 11th National People’s Congress, “in no way is less than 30%, therefore, average housing prices should drop by 30%”. He is not very optimistic about China’s economic prospects in the second half of 2021, what he fears most is a “hard landing” (硬着陆) by the real estate sector, resulting in a financial crisis. Therefore, he hopes for a “soft landing” (软着陆) in order to avoid the implosion. Evergrande’s problems demonstrate that. If the Chinese government let it fail, Chinese economy will be paralysed, millions of migrant workers employed in the construction sites will be unemployed, steel, cement, glass and various other ancillary industries will be affected and even go bankrupt, least to talk about the bad debts of the banks.

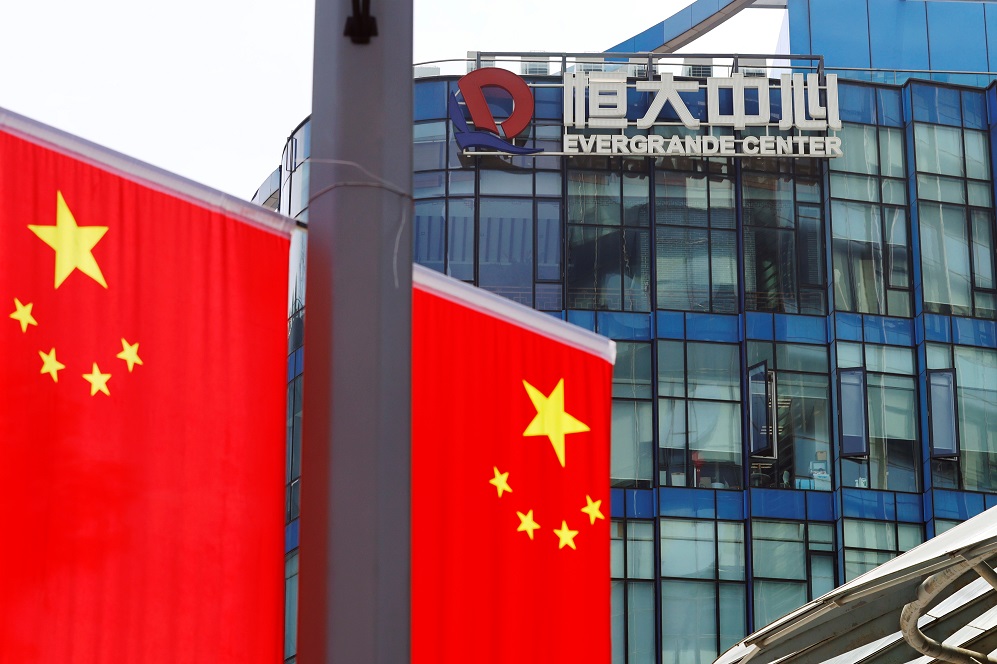

One may argue that a country having US$3.9 trillion in foreign exchange reserves may easily tide over the crisis of this magnitude. But is there enough cash? China’s foreign debt, according to the State Administration of Foreign Exchange, reached US$2.52 trillion by March 2021. It was also reported that fiscal debt in 2020 crossed US$1 trillion. Added to this, the finances of the provincial governments are pegged at around US$4 trillion. Now, Xu Jiayin, the owner of Evergrande is alleged to be close to the Shanghai clique. It was during Jiang Zemin’s reign that Xu rose to glory as a realtor. Red Roulette: An Insider’s Story of Wealth, Power, Corruption and Vengeance in Today’s China (2021) by Desmond Shum, also writes about the ways Xu bribed the big and powerful in China. “Xu’s preferred method was through giving outrageously expensive gifts” (p. 165). The Shanghai clique allegedly controls the financial sector in mainland and Hong Kong, of which Xi has been very wary of. Therefore, why should Xi Jinping bail out his detractors? And what about other developers such as Soho, Fantasia, Sunac, Ludi, Fuli, Rongchuan, Baolide, Wanda, Country Garden and many others who have also taken the plunge? Evergrande’s shares fell by around 80% in this year alone.

Given the threat of contagion spreading to other areas, one of the possibilities is the Chinese government managing the crisis by taking over Evergrande and nationalizing its assets and subsidiaries. If the reports are to be believed, Anqing city administration has already announced that it will take back all the landholding it had sold to Evergrande. On 22 September, China’s Central Bank injected a total of 120 billion yuan (about US$18.5 billion) of reverse repos to maintain liquidity in the banking system. This could also be interpreted as China taking measures to calm the nervousness amidst Evergrande crisis and falling Chinese equities across the globe. Meanwhile, Evergrande’s onshore property unit revealed on 22 September that it has negotiated a plan with bondholders to repay interest on local yuan bonds due on 23 September. In another story filed by Asiamarkets.com on the same day, it has been revealed that the Chinese government is planning to restructure Evergrande into three separate entities. This may also be the reason for a little rise in Evergrande’s share prices. Or, will the prophecy of the Wall Street Journal prove right when it claimed that China has made preparations for Evergrande’s demise. Whatever may be the outcome, the crisis, nonetheless, marks the end of laissez-faire growth in China.

B.R. Deepak is Professor, Center of Chinese and Southeast Asian Studies, Jawaharlal Nehru University.