MACROECONOMIC PERFORMANCE

India’s economy (as measured by real GDP) has been the fastest-growing among the world’s 20 largest economies for 7 of the past 9 years. And those were the only 7 years in the past 76 that India achieved that distinction. Additionally, real GDP per capita grew faster (averaging 6.12% annually) in the 2014-19 parliamentary term than in any previous parliamentary term in India’s modern history. And 2014-19 consequently also saw the fastest real GDP growth of any 5-year prime ministerial term (averaging 7.4% annually), well ahead of the average 6.9% annual growth in the 2004-09 first term of Manmohan Singh, who inherited the tail-winds of a current account surplus and record low interest rates from his predecessor, A.B. Vajpayee.

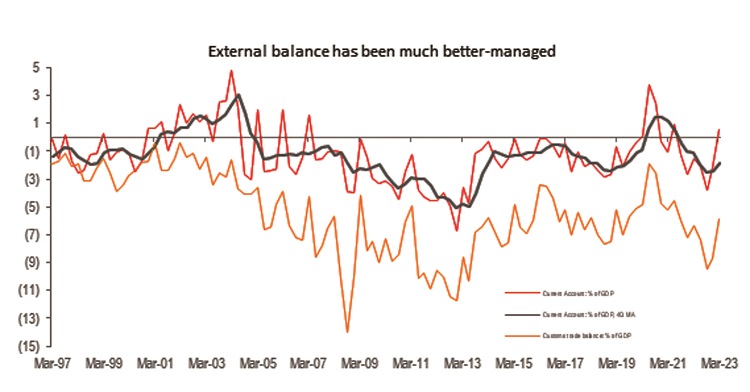

Faster growth is normally accompanied by a deterioration in the external balances, as occurred during Manmohan Singh’s first term. India’s current account deteriorated from a surplus of 2.4% of GDP in FY2014 (Vajpayee’s last year as PM) to a deficit of 2.3% of GDP in FY2009 (the end of Manmohan Singh’s first term). And although growth slowed in Singh’s second term, the current account deficit (CAD) widened to a record 4.8% of GDP in FY2013. By contrast, the CAD has stayed small throughout the past 9 years, averaging 1.38% of GDP in Prime Minister Narendra Modi’s first term (2014-19), and just 0.6% of GDP in the subsequent four years, helped by a surplus of 1.2% of GDP in FY2021. (See Chart 1).

In 2011 and 2013, during Congress rule, India was ignominiously grouped among the “Fragile Five” emerging economies at merely the hint of a tightening of US monetary policy. Although the US policy interest rate didn’t actually rise in either year, the rupee depreciated 15% within 6 months on both occasions. Between 2016 and 2019, with Modi ruling India, the US Fed Funds rate rose 225bp, but there was little impact on India’s external balances or the rupee. And when the US Fed Funds rate rose a further 500bp over the past 14 months (the fastest increase in 40 years), India stood out as a paragon of stability among emerging economies.

A key factor underpinning that sense of stability was that Modi’s India did not follow the global fashion of providing a massive fiscal stimulus during the pandemic. Ample fiscal support was extended to vulnerable groups, including the distribution of near-free foodgrain (continuing fully free to 813 million individuals in 2023). But tax revenues remained buoyant, comfortably funding the needed social spending. Thus, while the US fiscal deficit soared to 16.4% of GDP in 2020 and 11.3% in 2021, India stood out globally for keeping its fiscal deficit down to just 9% of GDP in FY2021 (despite the Covid-induced economic contraction that year). And the following year, India’s fiscal deficit moderated to 6.9% of GDP and is estimated to have shrunk to 6% in FY2023.

The last four years did encompass the Covid-19 pandemic, during which India suffered its worst annual economic contraction since Independence—real GDP declining 5.8% in FY2021. The imposition of a complete lockdown (except for agriculture) in the final week of Mar’20 was, perhaps, an excessive response, at a time when India was suffering barely 500 daily cases of Covid-19. But epidemiologists were warning that 300-500 million Indians would contract the coronavirus by July 2020, and that up to 2.5 million would die. India’s actual death toll was 0.53 million (primarily in the second wave a year later), but would probably have been much worse in 2020 without the lockdown.

The length of the lockdown effectively subtracted one quarter’s worth of economic activity, while the second wave lopped off another quarter the following year. But nonetheless, real GDP grew 9.1% in FY2022 and continued to exceed 7% in FY2023, restoring India’s status as the world’s fastest-growing large economy. Fiscal and monetary prudence have ensured that inflation has been muted. (See Chart 2).

CPI inflation averaged 10.1% annually between June 2009 and May 2014 (Manmohan Singh’s second term), but has averaged 5% annually in the 9 years since. When then-RBI governor Raghuram Rajan first proposed an inflation target to the Modi government in mid-2014, he aimed to get inflation down to 6% YoY by 2016. But prudent fiscal policy, including better management of the food subsidy, quickly brought inflation down to 4% YoY in Oct-Dec 2014!

That near-miraculous achievement of the Modi government enabled the RBI to propose a much lower inflation target of 4% YoY (with a 2pp range on either side, i.e., an effective target of 2-6% CPI inflation). Despite the challenges of Covid and the Ukraine war, the RBI has adhered to that target, and India’s inflation rate has remained well below the average inflation rate of its trading partners over the past year. While the US and Europe are obliged to keep raising interest rates, India has won its battle against inflation and needs no further rate hikes this year. On growth, inflation, and the twin deficits, then, the performance of the Modi government has been stellar.

REFORMS

India’s past governments have undertaken significant economic reform only when their backs were against the wall, a crisis was at hand, and the IMF demanded big reforms in order to provide the loans necessary to overcome the crisis. The only exception was Prime Minister Shastri, who voluntarily undertook the huge institutional reforms required to kickstart the Green Revolution in 1965. In 1980, the IMF gave India a US$5bn loan but enforced some structural reforms that placed the economy on a stronger growth path.

In 1991, India quickly ran through a $670mn IMF loan taken in January, but the IMF would only agree to a further essential loan of US$2.2bn if India undertook significant reforms to its protectionist import regime. Prime Minister Rao (who was also Industry Minister) quietly went further, largely dismantling the Kafkaesque maze of industrial licensing in July. But only after this had been done was the IMF loan approved that October.

By contrast, the Modi government has been instinctively reformist, aiming to make India more competitive without any pressure from the IMF. At the outset, the Modi government abolished hundreds of useless colonial-era laws aimed at improving the ease of doing business.

Prime Minister Modi inherited an economy that was faced with a “twin balance sheet crisis”—an over-leveraged corporate sector, and banks saddled with deteriorating loan books after financing that leveraging binge. His government’s key response was the Insolvency and Bankruptcy Code (IBC), which quickened the pace of debt resolutions, and helped to gradually improve banks’ balance sheets. The IBC was a huge advance on the past, in which “sick companies” would remain interminably troubled, their bad debts clamming up the system for decades without resolution. (The SARFAESI Act passed by the previous NDA government in 2002 was promising, but was largely ignored by the UPA government, and hence withered from disuse).

India had long planned a Goods and Services Tax (GST) to remove the congeries of individual state taxes and octrois, in order to genuinely make the nation a single market with unimpeded movement of goods and services across state lines. Past governments had failed to get anywhere near implementing a GST. But in July 2017, the GST was finally rolled out, and it has clearly been a major advance on the past, simplifying the indirect tax system hugely. However, unlike GSTs elsewhere in the world (EU, Singapore, China), India did not impose a single rate of GST for all goods and services, but differentiated rates with numerous exemptions. The GST is, thus, an advance on the past, and has provided a significant boost to central and state revenues, but is far from optimal.

Nonetheless, GST was part of a trifecta of reforms aimed at sharply reducing the use of black money (undeclared income). In September 2016, the voluntary disclosure of income scheme (VDIS) gave a last opportunity to holders of undeclared income to declare it, or otherwise face stringent action. The demonetization of larger denomination currency notes on 8 November 2016 smoked out black money, and the GST completed the circle by ensuring that each transaction would be routinely reported by both parties, making evasion impossible without collusion among each party to a transaction. There is little doubt that the use of undeclared income in transactions has declined sharply, including in the real estate sector. (The 1988 Benami Transactions Abolition Act was finally notified in September 2016, further tightening the screws on black money).

Prime Minister’s Modi’s ambitious Make In India initiative, aimed at strengthening the manufacturing sector, has had mixed results. Foreign Direct Investment (FDI) into India has been well over double what it was in the past. But a lot of this has continued to go into the Services rather than manufacturing sector. The government sharply cut the corporate tax rate to 25% (effective) in September 2019, and also introduced an effective corporate tax rate of 17% for new manufacturing units—making India tax-competitive with the lowest-tax jurisdictions in the world, especially for new manufacturers.

When even this proved only modestly successful, the government rolled out the Production-Linked Incentive (PLI) scheme, providing an incentive payment to specific sectors when a company increased production by 6% or more within a year (and other export and output targets for entirely new industries). This has had particular success in building an inchoate electronics manufacturing sector, with India’s electronics exports leaping by 296% since FY2017 to US$23.6bn in FY2023.

INFRASTRUCTURE

India’s rickety roads, ports and airports were historically seen as one of the greatest impediments to the progress of her economy. PM Vajpayee began addressing this challenge with his Golden Quadrilateral highway-building initiative. The Modi government has given India a world-class transportation infrastructure, adding 50,000 km of new highways (twice the amount added during the UPA decade). The number of airports have doubled from 74 to 148, and passenger flow rose from 60 mn in 2013 to 141 mn in 2019, and is set to considerably surpass that this year. India’s vastly improved ports have become competitive in cargo handling, helping to smooth India’s international trade.

Disgracefully, more than half of all households didn’t have bank accounts, cooking gas or a toilet before 2014; the Modi government has universalised access to all three (with a usable toilet at home or school being a key part of the Swachh Bharat Abhiyaan). Universal bank accounts enable direct benefit transfers (DBT), cutting out the middlemen who often stole most of the government’s welfare payments long before they reached the beneficiary. The vast majority of rural citizens at last is acquiring the wherewithal for a civilised modern existence.

But the greatest transformation of all is the “digital stack”, one of PM Modi’s pet projects. Through his Jan Dhan Yojana, he first ensured that every household had access to a bank account. The rollout of Aadhar (proposed by the Singh government, but universalised only by Modi’s drive), and the ubiquity of mobile phones created the JAM (JanDhan-Aadhar-Mobile) trinity through which the universal payments initiative (UPI) made India a world leader in digital payments. With 800mn Indians having access to the internet, entrepreneurship is flourishing across rural and urban India, with a proliferation of unicorns (billion-dollar startups) providing the foundations of the new India that could truly aspire to being a developed economy by 2047.

Prasenjit K. Basu is the chief economist of ICICI Securites, and the author of the prize-winning book, “Asia Reborn”.