On monetising infrastructure, government is on the right track

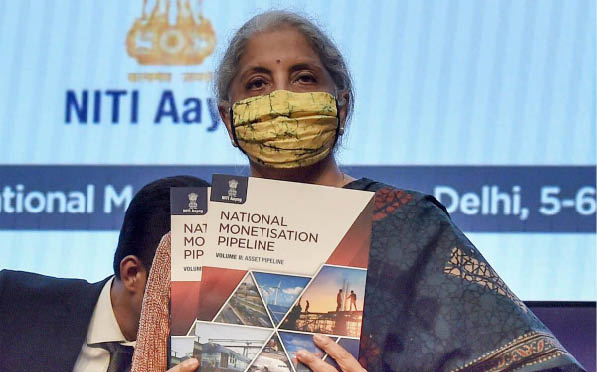

It will be unfortunate if the only prism through which the National Monetisation Pipeline is viewed is the revenue which it will earn the government—approximately Rs 6 lakh crore over four years. This is not an exercise to bridge the fiscal deficit in tough times. At least it should not be. This isn’t a fire-sale of India’s assets—strictly speaking it isn’t a sale at all because the Pipeline will be monetized via a form of lease and will continue to be owned by the government. This is about building many more assets for New India. If implemented well, along with privatization, this could be legacy-defining for the Narendra Modi government.

Building infrastructure is lengthy, costly and complicated but utterly necessary. It defines a nation’s competitive advantage. It has a huge multiplier effect in the economy and is the foundation for rapid, double-digit growth. Financing infrastructure is a huge challenge. The Prime Minister has committed, more than once, most recently on Independence Day, a sum of Rs 100 lakh crore towards investment in infrastructure in the next five years. By itself, the government does not have the fiscal space to fund the entire amount. Private participation, from India and overseas, is essential if ambition is to become reality.

Public-private partnership in infrastructure is not new. It has been implemented in different forms for the last two decades. There are two distinct parts to any large infrastructure project: building and operation/maintenance. In the past, the private sector was encouraged to partner the government at the very first stage. Intuitively, that made sense since the private sector in India is known to be more efficient than the government in both executing projects from inception and running them. To borrow an analogy from trade, it has an absolute advantage over the government in both aspects. However, if viewed in terms of comparative advantage, the government would possess it in the first part of the project (building) and the private sector in the second (operation and maintenance).

The first stage of a large infrastructure project requires two things above all else. First, a bevy of clearances related to land acquisition, environment and forest clearances and several other steps of “red tape”. Second, it requires the raising of a large amount of capital to finance the project. While the private sector can do both of these activities, it may be easier and less risky for the government to do them. After all, clearances are all in the domain of government agencies. These are likely to be more cooperative if the government is leading a project. On financing, Budgetary allocation can provide the necessary financial muscle for big-ticket projects, whereas the private sector would have to take on riskier and more expensive funding. Needless to say, the government is highly disadvantaged on the operations and maintenance side because of political economy constraints in charging appropriate user fee (look no further than the bankrupt electricity discoms) and a poor discipline in maintenance of its own assets (look no further than most government offices).

A decade ago, PPP got a bad name because this theory of comparative advantage was ignored. Too many projects being led by the private sector from inception went belly up because of inordinate delays in “permissions” which led to stalling or unaffordable cost escalations. Many projects were financed by banks with unrealistic assumptions, eventually leading to a spate of NPAs in the banking system. In any case, banks, whose deposits are short-term, should not be lending for infrastructure, which has a long-time horizon for returns. In the end, the losses ended up being socialized, i.e., billed to the taxpayer, whereas in the few projects that did well, profit went into private hands.

The Modi government made an entirely appropriate course correction by bringing back to the government fold, the first half of an infrastructure project, namely its building. The logical follow up to that is to lease out the built assets to the private sector for operation and maintenance. The revenue the government earns from this can then be channeled to build new infrastructure projects. When those are monetized, it frees up resources for another round of building, creating a virtuous cycle.

As with privatization, the devil lies in the implementation of the policy. There is a danger that the terms of contract are set in a way that dissuades private sector participation. There is a risk of political backlash if terms are perceived to favour private parties. There is also a possibility that too many assets get cornered by a handful of players leading to oligopolies or monopolies in some sectors thereby hurting consumer interests. The absence of credible independent regulators in these infrastructure sectors could become a hindrance to successful implementation. The government must empower regulators by freeing them from administrative ministries and the Competition Commission of India must stay vigilant.

It would require a lot of work and courage to execute the National Monetisation Pipeline. The returns would be worth the effort.

Dhiraj Nayyar is Chief Economist, Vedanta.