NEW DELHI: US DoJ investigates short-selling practices, including by Hindenburg in the Tecnoglass case.

On 9 December 2021, Hindenburg Research published a short-seller report on Tecnoglass, a Colombia-based glass manufacturing company. The said sensational report was named “Cocaine cartel connections, undisclosed family deals, and accounting irregularities all in one Nasdaq SPAC.”

After the publication of the report, which raised red flags about Tecnoglass’ alleged links with criminal network and related governance issues, the price of Tecnoglass shares slipped by over 40%. From $31.77 it went down to $18.67 after the “report” was published. It lost nearly $1 billion that day.

Almost three and a half years later, it is now trading at the New York Stock Exchange at $58, three times of what it was when the said report had come out. In November 2023, Forbes named Tecnoglass as the number 1 US small-cap company.

Following the Hindenburg allegations, which failed to cause the expected dramatic downfall of the company, the US Department of Justice (DoJ) initiated a comprehensive criminal investigation into this practice of short selling.

This probe, managed by the department’s fraud section in conjunction with federal prosecutors in Los Angeles, centred on the practice of short selling by hedge funds and research firms. It was also asked to examine their interconnected relationships and improper trade coordination or illegal activities intended to generate profits.

The DoJ was mandated to look at how hedge funds accessed research and established their positions, particularly in relation to reports that influence stock prices. It also was asked to probe if money managers manipulated stock prices or engaged in abuses such as insider trading, engaged in deceptive practices, including misleading the public about the funding of seemingly independent research, and orchestrated stock drops to induce panic among shareholders and drive further selling.

The Sunday Guardian reached out to the DoJ for a response on this probe and its overall findings, but none was shared till the time this report went to press.

DOJ FOCUS ON SHORT SELLING & ANDREW LEFT’S INDICTMENT

Among the firms that were under the radar of the DoJ at the time included one that was owned by Citron Research, a firm owned by a California-based individual, Andrew Left, who is a prominent short seller.

Last month, a federal grand jury in the Central District of California formally charged Left on multiple counts of securities fraud for a long-running market fraud scheme reaping profits of at least $16 million.

As per the 38-page indictment, the 54-year-old Left, who was a securities analyst, trader, and frequent guest commentator on cable news channels such as CNBC, Fox Business, and Bloomberg Television, conducted business under the name “Citron Research” (Citron), which he created as a vehicle for publishing investment recommendations. Citron’s online presence included a website and a social media account on X, formerly known as Twitter, where he would present his “reports” on publicly traded companies, asserting that the market incorrectly valued a company’s stock and advocating that the current price was too high or too low.

Among those companies that were targeted by Left included, India Globalization Capital (IGC), which was founded in 2005 and is based in Bethesda, Maryland, and was the only Indian infrastructure company listed and trading in the United States. It changed its name to IGC Pharma in March 2023.

Left, along with another hedge company, targeted IGC in or about October 2018 and executed a short campaign targeting the company.

As per the indictment, knowing that Citron’s influence on the market was largely based on Left’s personal reputation and market-moving capacity, Left falsely represented that he did not share Citron’s commentary with hedge funds before the reports were published.

In truth, as per the DoJ investigation, Left often provided third parties, including hedge funds, with advance notice of the anticipated publication of Citron’s commentary to enable the third parties to profit by trading around the commentary and, in other instances, mitigate their losses by adjusting their positions before publication.

Left’s recommendations often included an explicit or implicit representation about Citron’s trading position—which created the false pretence that Left’s economic incentives aligned with his public recommendation—and a “target price,” which Left represented as his valuation of the company’s stock.

As per the indictment, Left published his recommendations in Citron-branded reports, articles, and social media content and promoted them through media campaigns, including outreach to members of the news media, appearances on cable news programs, and interviews published in news articles online.

The commentary routinely included sensationalized headlines and exaggerated language to maximize the reaction it would get from the stock market. As alleged, Left posted recommendations on social media to manipulate the market and make fast, easy money.

Significantly, in the lead-up to the publication of Citron’s commentary, Left established long or short positions in the public company on which he was commenting in his trading accounts and prepared to quickly close those positions post-publication and take profits on the short-term price movement caused by his commentary.

While Left made false representations to the public to bolster his credibility, behind the scenes, Left allegedly took contrary trading positions to reap quick profits off the stocks he either promoted or pilloried through Citron, the DoJ probe found.

Similar practices were alleged to be put to effect by Hindenburg against the Adani group last year.

MODUS OPERANDI OF SHORT SELLING

In its subsequent filings with government bodies, Tecnoglass, which was shorted by Hindenburg, presented the modus operandi that is adopted by short sellers and how they profit from such “rumours”.

“Short selling is the practice of selling securities that the seller does not own but rather has borrowed from a third party with the intention of buying identical securities back at a later date to return to the lender. The short seller hopes to profit from a decline in the value of the securities between the sale of the borrowed securities and the purchase of the replacement shares, as the short seller expects to pay less in that purchase than it received in the sale. As it is therefore in the short seller’s best interests for the price of the stock to decline, many short sellers (sometimes known as ‘disclosed shorts’) publish, or arrange for the publication of, negative opinions regarding the relevant issuer and its business prospects to create negative market momentum and generate profits for themselves after selling a stock short,” says Tecnoglass.

“Although traditionally these disclosed shorts were limited in their ability to access mainstream business media or to otherwise create negative market rumors, the rise of the Internet and technological advancements regarding document creation, videotaping, and publication by weblog (blogging) have allowed many disclosed shorts to publicly attack a company’s credibility, strategy, and veracity by means of so-called ‘research reports’ that mimic the type of investment analysis performed by large Wall Street firms and independent research analysts. These short attacks have, in the past, led to selling of shares in the market, on occasion in large scale and broad base. Issuers who have limited trading volumes and are susceptible to higher volatility levels than large-cap stocks can be particularly vulnerable to such short seller attacks,” Tecnoglass adds.

“For example, on December 9, 2021, Hindenburg Research LLC, issued a report containing allegations against us and certain members of our management team which negatively impacted the trading price of our ordinary shares. We devoted significant resources in investigating and disputing these claims, including the formation of an independent Special Committee of the Board of Directors that engaged an outside law firm which in turn engaged a ‘Big 4’ accounting firm to carry out the investigation,” Tecnoglass claims.

“In light of the limited risks involved in publishing such information, and the enormous profit that can be made from running a successful short attack, unless the short sellers become subject to significant penalties, it is more likely than not that disclosed short sellers will continue to issue such reports,” the filing by Tecnoglass reads.

To the benefit of the short sellers, both in India and the US, short seller publications are not regulated by any governmental, self-regulatory organization, or other official authority nor are they subject to certification requirements imposed by anybody and accordingly, the opinions they express may be based on distortions or omissions of actual facts or, in some cases, fabrications of facts.

HINDENBURG’S TAX LIABILITY AMIDST FINANCIAL TURMOIL IN INDIA AND WORLD

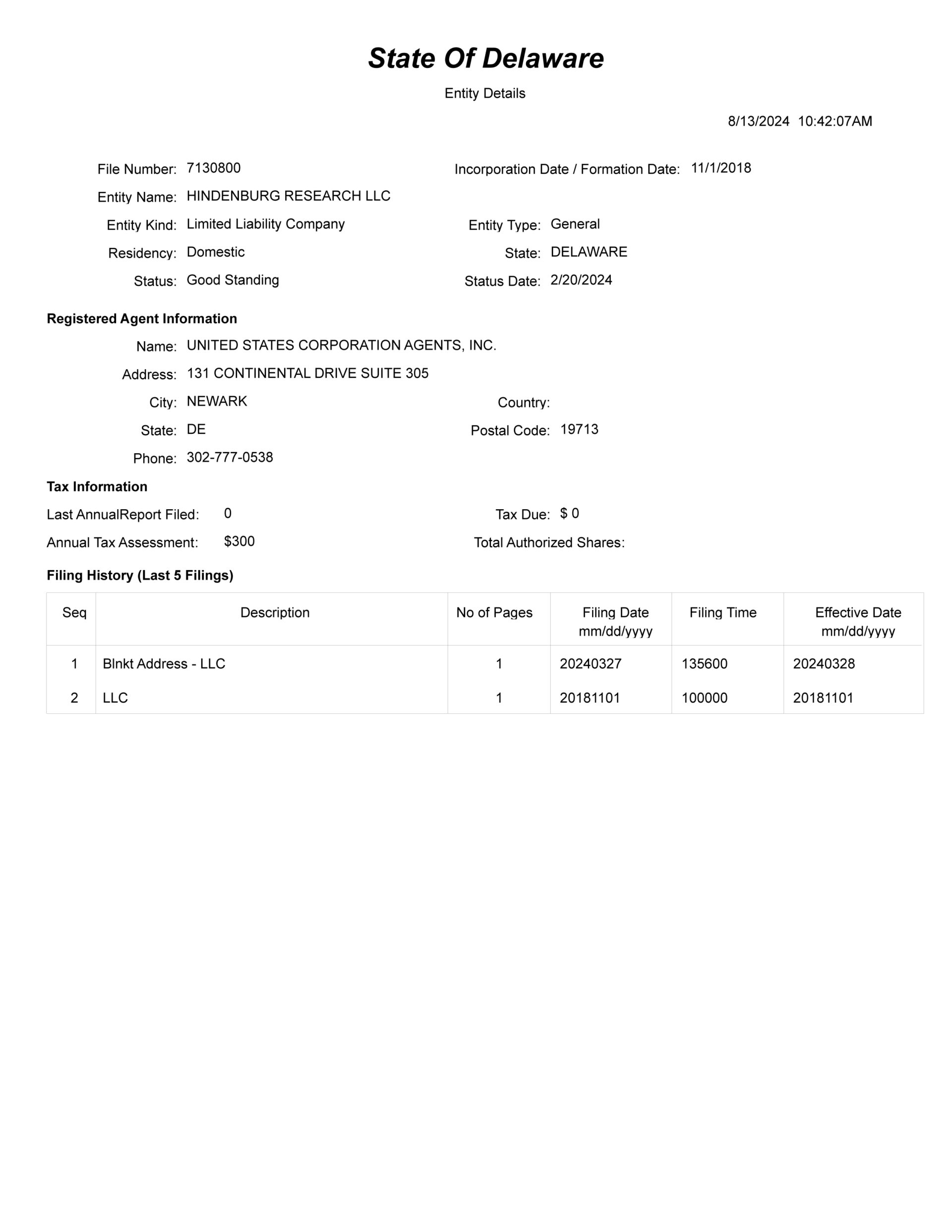

Documents filed by Hindenburg Research, accessed by The Sunday Guardian, after paying government-regulated fees, show that the said entity, which was incorporated as a Limited Liability Company in November 2018 and is registered in Newark, Delaware, paid $300 as tax at the end of March this year.

As per US laws, Limited Liability Companies (LLCs), Limited Partnerships (LPs), and General Partnerships (GPs) are not required to file Annual Franchise Tax reports with the Division of Corporations. However, they must pay the $300 annual tax.

LLCs are typically considered pass-through entities. This means the LLC’s profits and losses “pass through” to the owners’ individual tax returns. Owners (members) report their share of the LLC’s income or loss on their personal tax returns.

In July this year, Hindenburg Research, while responding to Indian market regulator, Securities and Exchange Board of India (SEBI), wrote that it had earned $4.1 million in revenue from gains made by shorting Adani securities. The short-seller’s report led to a staggering $153 billion wipe-out in the market value of the Adani Group. It also made $31,000 by shorting Adani’s US bonds, which Hindenburg said was a tiny position.

However, market specialists allege that given the recent findings by the DoJ, in the case of Andrew Left and Citron, who made $16 million while shorting shares of much smaller companies, the figure that Hindenburg has claimed to earn in Adani’s case is “way-way” less than what they actually have earned, a significant portion of which has likely gone to investors and those who took the “service” of Hindenburg Research.

According to analysis by data specialists, “Breakout Point,” 2020 saw 177 new major short campaigns. On an average, stocks targeted by these short calls were 7% lower one week after the report but ended the year about 28% higher.

Breakout Point tracked 74 short positions initiated by Hindenburg Research since 2017. In 53 of these cases, the target stock’s price declined, resulting in gains for Hindenburg.

In 2020, Hindenburg Research secured five of the top ten spots on Breakout Point’s list of best-performing short calls. Notably, Hindenburg was the most active short seller, targeting 24 companies—twice as many as its competitor, White Diamond.

In 2022, Hindenburg’s ten targets saw an average share price drop of 42%. In 2023, its seven targets experienced an average decline of 36% .By the first quarter of 2024, Hindenburg had two of its shorts ranked among the top ten best-performing short calls: US biotech company Renovaro and Swiss fintech firm Temenos.

As per data by Insightia, a US based market research company, from 2013 to 2021, 1,693 shorting campaigns were launched globally, with about 1,200 of these being Asian companies. During this campaign, the average return that these short sellers got was 7.36% (at the end of one month) with the highest return being 11.94%, while the lowest being 2.20%.

To calculate the basic return of a campaign, the stock price of the said company before a significant company announcement is compared to its price on a later date when the said announcement is made. The difference between these two prices represents the basic return of the campaign.