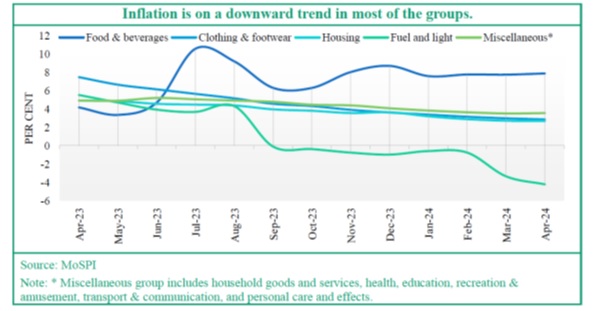

NEW DELHI: The Finance Ministry is banking on stronger external support for domestic manufacturing in the upcoming months and greater focus by an increasing number of organisations in the US and Europe on enhancing supply chain resilience to benefit India’s manufacturing firms as part of the China Plus One strategy. At the same time, prediction of a normal southwest monsoon auguring well for food production and easing of price pressures, positive show by industrial and service sectors backed by brisk domestic demand, increased credit flow to transport and real estate segments and policy support and robust investments in physical, digital infrastructure and logistics create strong macro-economic buffers that are expected to help the real sectors of the economy navigate the external headwinds smoothly and continue the growth momentum of the previous year, the Finance Ministry says in its monthly economic review for April.

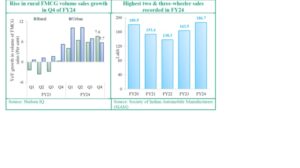

Expressing optimism over the Indian economy closing FY24 strongly with its growth surpassing market expectations, despite strong external headwinds, the MER takes stock of early indications and emerging robust trends in important high-frequency indicators of growth like the GST collections, e-way bills, electronic toll collections, sale of vehicles, purchasing managers’ indices and the value and number of digital transactions that suggest a continuation of the economic momentum during the first quarter of FY25. The GST collection recorded a 12.4 per cent year-on-year (yoy) growth driven by strong increase in domestic transactions of 13.4 per cent and imports of 8.3 per cent, jumping to a high of Rs 2.1 lakh crore in April 2024.

Supporting these indicators, India’s transportation sector has seen a significant increase in activity recently, with a 15 per cent increase in domestic air passengers in March 2024 — 6 per cent more from February 2024 — rail freight traffic also increased by 4.9 per cent yoy, amounting to 1434 million tonnes from April 2023 to February 2024, vehicle registration went up by 27 per cent yoy to 2.2 million in April 2024 and fuel usage in April 2024 increased by 6.1 per cent yoy, totalling over 19.9 million tonnes. Toll collection registered continued growth in April 2024, electricity consumption also accelerated in April due to rising temperatures and increased industrial activity.

Setting the stage for a continued impetus to economic activity in FY25, fixed investment is gathering pace on the back of the focus of the Government on capital spending and the resultant crowing in of private investment, notes the Finance Ministry, citing the surveys of the Reserve Bank which indicate improving consumer confidence and industrial outlook. Investment activity continues to display stability despite ongoing geopolitical headwinds. As per the second advance estimates of national income released by the National Statistical Office (NSO), the gross fixed capital formation (GFCF) is expected to be the largest GDP growth driver in FY24, with a percentage contribution of 44.9 per cent.

While investment activity remains expansive, consumption is being propelled by consistent growth in urban demand and a resurgence in rural demand, thereby contributing to India’s growth in FY24, the Finance Ministry review observes. As per the data published by Nielsen IQ, the volume sales of fast-moving consumer goods (FMCG) in rural markets saw a rise of 7.6 per cent in the Q4 of FY24 on a yoy basis. For the first time in five quarters, rural FMCG demand growth outpaced urban growth. According to the RBI’s consumer confidence survey for April 2024, the current situation index (CSI) rose by 3.4 points to 98.5 in March 2024, the highest level since mid-2019. Consumers are quite optimistic about the general economic situation, income and spending.

On the external front, despite global challenges, India’s foreign exchange reserves are comfortable, and the Indian rupee has been one of the most resilient vis-à-vis the US dollar in recent months.

After ending FY24 on a strong note, India witnessed a net outflow of foreign portfolio investments of USD 1.8 billion in April 2024. This is attributed to profit-booking by market participants amidst higher market valuations and uncertainty in global markets regarding interest rate cuts by major central banks. Despite volatile FPI flows, the rupee continues to remain one of the most stable major currencies. Between 2nd January 2024 and 15th May 2024, the rupee depreciated by 0.2 per cent against the US Dollar. Between 1 April 2024 and 15 May 2024, the rupee depreciated marginally by 0.11 per cent. A stable rupee has also aided the RBI build significant forex reserves, which, as of 10 May 2024, stood at USD 644.2 billion.

However, there are substantial multi-frontal challenges from unrelenting geopolitical tensions and volatility in global commodity prices, especially of petroleum products, Nonetheless, the Finance Ministry expects the macro-economic buffers nurtured and strengthened during the post-Covid management of the economy to help the Indian economy navigate these challenges reasonably smoothly.