Heavy dependence on oil and its imports has brought the renewable energy sector into sharp focus over the last few years with solar and wind power projects booming, thanks to government incentives and financial interest from institutional investors . With a target of achieving 50% of its energy from non-fossil fuel sources by 2030, the country is positioning itself as a leader in the clean energy transition.

Tata Power is one of India’s largest integrated power companies with over a century of expertise in power generation and is now transitioning from traditional coal-based power to renewable energy and aligning with the global and national push for sustainability. Tata Power’s performance and future prospects make it an attractive investment, particularly after its strong Q2FY2025 financial results that further emphasises its leadership in the renewable energy space. It reported a consolidated net profit of Rs 1200 crores reflecting a robust 20% year-on-year increase compared to Q2FY2024.

The rise in profitability has been driven by its renewable energy business which has seen significant growth in both capacity and revenue. Revenue for Q2 FY2025 stood at ₹14,750 crore which is a 12% increase year-on-year while the EBITDA margin expanded due to operational efficiencies and higher capacity utilisation. The solar and wind power projects with its renewable energy capacity now stands at 5000 MW and significant additions are expected over the next few quarters. The company’s emphasis on asset-light models in solar rooftop installations, solar EPC services and electric vehicle (EV) charging infrastructure has also contributed to its strong Q2FY2025 financial performance. Tata Power’s strategic shift towards renewable energy has paid off with nearly 38% of the company’s total generation capacity now coming from clean energy sources including solar, wind, hydroelectric power and waste heat recovery.

Its subsidiary, Tata Power Renewable Energy Limited has been instrumental in driving this growth having ambitious plans to scale up its renewable energy capacity to 80% by 2030. On the other hand , it has become a leading name in solar power with its solar business experiencing tremendous growth. Tata Power Solar has achieved new milestones in solar rooftop installations and solar EPC services with its solar EPC order book currently over a whopping Rs 10000 crores. The company has completed multiple projects for residential, industrial, and commercial customers focusing on delivering integrated solar solutions, solar power systems, energy-efficient lighting and energy storage systems making it a key player in India’s solar energy transformation.

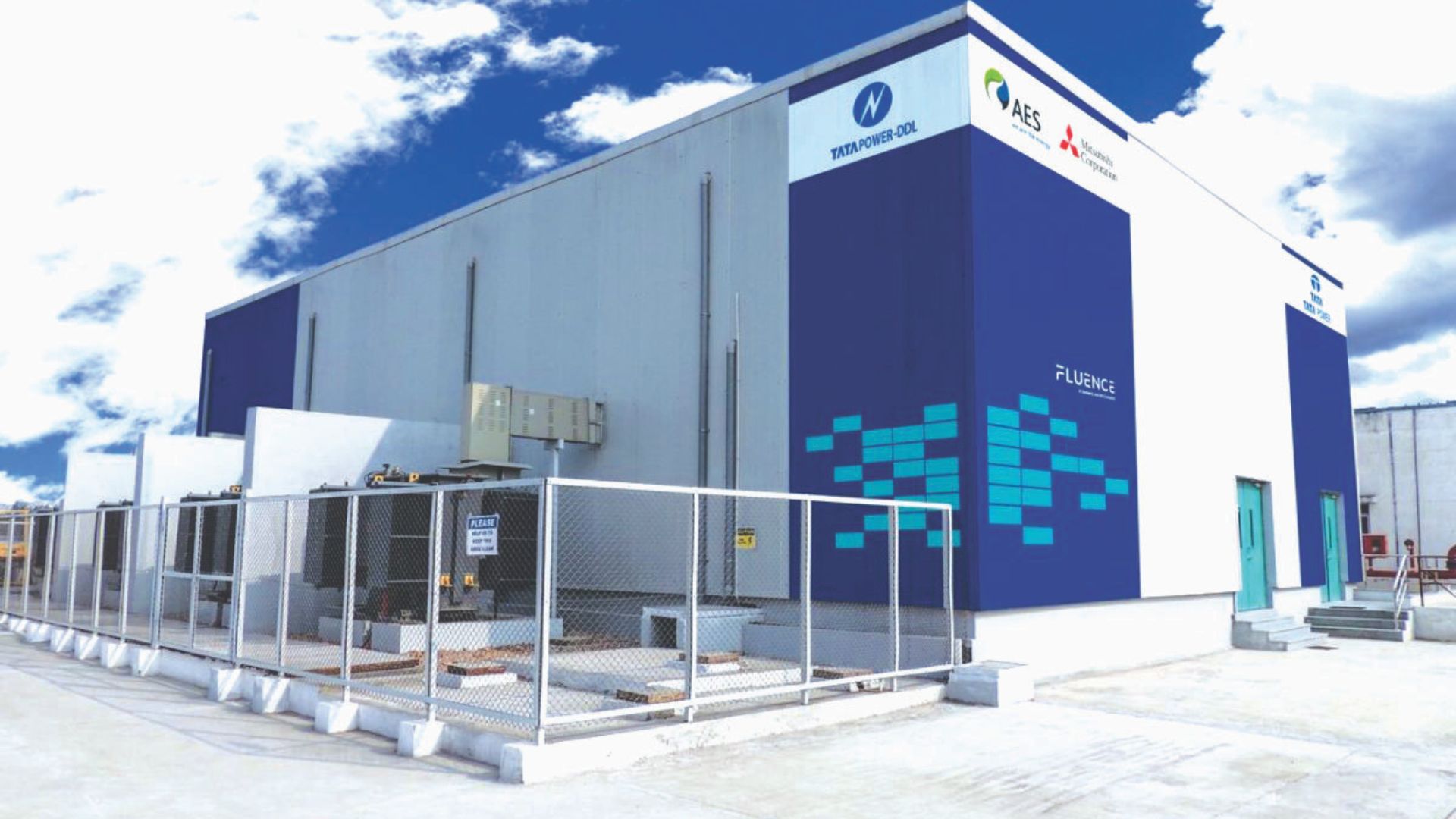

The company’s leadership in solar EPC services has made it a preferred partner for government-backed initiatives like rooftop solar installations under the National Solar Mission. It has forged multiple strategic partnerships to strengthen its renewable energy business attracting significant foreign investments from BlackRock Real Assets and Mubadala Investment Company, which have infused $525 million into Tata Power’s green energy platform. It is also investing in innovative technologies such as battery storage and grid modernisation ensuring its leadership position in the sector for years to come. The company’s venture into the electric vehicle (EV) ecosystem is also noteworthy having set up over 2500 EV charging stations across the country and plans to expand this network to 25000 EV charging stations by 2027 .This strategic move aligns with the government’s push for increased electric vehicle adoption making Tata Power a critical player in the development of India’s EV infrastructure.

The future is extremely bright for the company having outlined an ambitious roadmap to scale its renewable energy portfolio and to achieve 25 GW of renewable energy capacity by 2030 with a primary focus on solar, wind and hybrid projects. It is exploring opportunities to further diversify its portfolio in green hydrogen and other emerging clean energy technologies . Tata Power’s strong Q2FY2025 financial

(Corrigendum: The company has not yet announced their Q2FY25 results and all the figures attached in the article mention Q2FY25, which is not possible. The error is regretted by the author.)