We are seeing top-down advocates—governments, multinational corporations implementing the technology to solve real business and environmental challenges.

London: Both Blockchain technology and the digital assets created by it, not only have the potential to, but actually are transforming governments, industries and even people’s behaviour globally. While Blockchain technology has been around since the 1970s it was not until 2008, following the financial turbulence that resulted in the collapse of Lehman Brothers and the creation of Bitcoin, that the technology was broadly unknown of (apart from in academic circles). Bitcoin harnessed Blockchain technology, allowing people to do what BP refers to as being able to carry out “Trusted Interactions Over The Internet”, thus enabling strangers world-wide to buy and sell from each other without using banks and in an anonymous fashion. Unfortunately, this gave rise to those who were involved in nefarious activities such as money laundering, arms dealing, drug barons, human trafficking etc., to be among the early adopters and users. Websites such as “The Silk Road”, where guns, narcotics and even assassins could be bought, flourished, with transactions using untraceable Bitcoins as the currency of choice. This meant that when the FBI finally closed The Silk Road in October 2013, the FBI became one of the largest holders of Bitcoin.

In simple terms, Blockchain technology enables:

* Creation of database: Like an Excel spreadsheet, it has military-grade security, with copies of the data held in multiple locations.

* Transfer of value without double counting.

* Digital Footprint: Immutable record of transactions/information.

* Transparency: Provenance, traceability.

* Risk mitigation: Programming in compliance and regulations.

All over the world these qualities led “tech-startups” to work on projects tackling almost every industry, as well as charitable endeavours—SC Johnson and Plastic Bank’s initiative to recycle 10,000 tons of plastic being an example of helping the unbanked, and even businesses, designed to change people’s behaviour and so improve the environment.

What many of these organisations often needed was capital, subsequently leading to the creation of what become known as Initial Coin Offerings (ICOs). ICOs were seen as a way to raise money, and in 2014 Mastercoin launched the first ICO. However, it took nearly three years for ICOs to really take off (which has since resulted in over 5,500 tokens being issued), raising over $30 billion on a global basis.

It was not just start ups that launched ICOs. In Germany, a company called Naga (https://www.nagaico.com) was the first European-quoted firm to launch an ICO, raising over €40 million from 63,000 participants. This was particularly interesting as, historically, German investors tend to be cautious and this ICO was based in Belize.

The problem was that ICOs were unregulated by many governments and financial regulators, so leading to a number of questionable operators and outright Ponzi schemes and scams. It has been claimed that up to 80% of all ICOs are scams. This seems rather harsh, but no doubt there were some very questionable ICOs. Unfortunately, many ICOs have struggled to survive.

It has not all been doom and gloom as, for example, Ripple claims the World Bank calculates there are $1.6 trillion of costs incurred as money is moved from one bank to another globally. This is a market in which a staggering $150 trillion of monies are transferred between banks and Ripple claims it can do this job faster and cheaper than the current SWIFT system that is used. Whilst only Santander Bank is an equity owner in Ripple, over 100 international banks are now doing trials using Ripple, possibly explaining why it rose in value by over 35,000% in just 2017. No wonder ICOs caught the investors’ imagination as they sought the next crypto to solve their personal financial woes.

Clearly, the impact of Blockchain and digital assets on our lives is now just beginning to be realised, so it is no surprise that leading business leaders have made comments such as these:

* “What the internet did for communications, I think blockchain will do for trusted transactions”—Ginny Romtty, ex-CEO, IBM.

* “Bitcoin is a remarkable cryptographic achievement and the ability to create something that is not duplicable in the digital world has enormous value”—Eric Schmidt, CEO, Google.

* “Your kids won’t know what (paper) money is”—Tim Cook, CEO, Apple Inc.

In the financial services sector, we are seeing Blockchain technology being used to help lower costs and remove some of the third parties currently involved in issuing bonds. The World Bank (in conjunction with Commonwealth Bank of Australia [CBA], Royal Bank of Canada and TD Securities) has, for the second time in a year, used Blockchain technology to issue a bond raising $33 million, taking the total amount raised using this method to over $100 million.

According to Thompson Reuters, in 2018, there was over $6.6 trillion of debt issued globally in that year alone. If the costs of issuing bonds could be reduced by just 0.1% (some firms claim it could be a lot more) then potentially the savings could be in the order of $660 million a year. Little wonder there is more and more interest in using Blockchain technology to cut out layers of costs and intermediaries, not to mention the greater transparency and risk controls that can be implemented. It is not just the cost saving of using Blockchain technology to issue bonds, but also the enablement of smaller tranches of bonds being issued by SMEs, thus offering these organisations access to a new source of capital. In addition, this could lead to smaller bond offerings, thus challenging the Peer2Peer lending markets which have proved to be so successful in the last few years.

Blockchain technology is also being used in the asset management sector via the tokenisation of funds, which Deloitte summarised by stating, “Tokenisation allows the creation of a new financial system—one that is more democratic, more efficient and vaster than anything we have seen”. Tokenisation of an existing fund enables it to be more relevant and suitable for younger fund buyers i.e. Generation X and millennials, who are increasingly looking to buy and sell funds digitally on mobile devices, without the need for face-to-face financial advice. Tokenisation can create more transparency, from which it is possible to build stronger compliance monitoring due to automation-increased efficiency and lower transactions costs. This makes tokenisation of a fund a powerful incentive for asset managers to adopt.

In addition, there are potentially the additional compliance controls using Smart Contracts, but these, coupled with greater transparency and traceability to improve KYC and AML checks, make the use of Blockchain technology highly compelling.

Ironically, it was concern over the “dark web” and anonymity of Bitcoin (which uses Blockchain technology) that made regulators suspicious, and initially cautious of digital assets and the Blockchain technology. However, we could now well see the implementation of Blockchain technology being actively encouraged by these very same sceptics.

AGRICULTURE EMBRACES BLOCKCHAIN TECHNOLOGY

It is not just in the financial services sector that we are seeing Blockchain technology being embraced. In agriculture, Blockchain-powered platforms are being built to make the tracking and provenance of food easier, while improving the efficiency of supply chains for all those involved. In Brazil, coffee farmers will soon have access to a Cryptocurrency called “coffeecoin”. According to a report on Bloomberg, coffeecoin is being launched by one of Brazil’s biggest Arabica-coffee co-operatives, Minasul. The coffeecoin will enable coffee farmers to buy machinery and fertilizer, as well as non-farm products such as cars and food. The use of Blockchain technology in the agriculture and food supply chain sectors is currently estimated to be $61+ million, and, according to ReportLinker, is projected to grow by 47% per annum to reach $429+ million by 2025. This growth is being driven by customers demanding greater transparency as to where the food they buy is coming from, how sustainable it is and the environmental impacts of what they are consuming. In the US, big tech firms such as IBM and Microsoft and international retailers and food processors such as Walmart, McCormick & Co and Dole Food Company are driving the use of Blockchain technology in agriculture.

CHANGING BEHAVIOUR

Blockchain technology and digital assets are not just being used to raise capital but as part of a firm’s marketing strategy, are being used to engage and reward their existing and prospective customers.

* According to Bain and Company, a 5% increase in customer retention can increase a company’s profitability by 75%.

* Gartner Group statistics tell us that 80% of a company’s future revenue will come from just 20% of its existing customers.

* According to Marketing Metrics it is far easier (about 50% easier) to sell to existing customers than to brand new prospects.

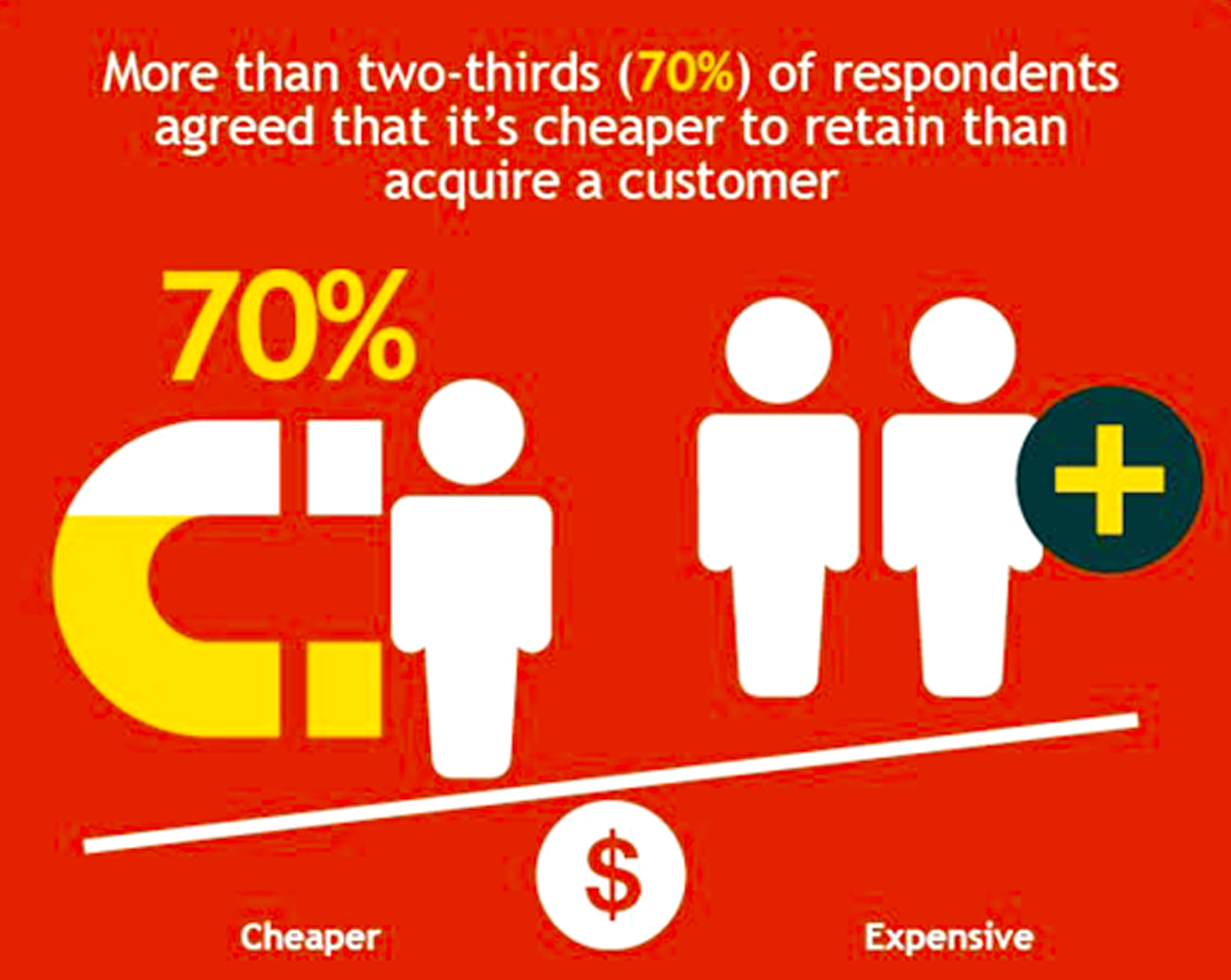

Increasingly, organisations are understanding the importance of why they need to look after their existing clients. As the environment in which we live and do business becomes progressively more digital, so companies are adapting and having to engage with us digitally, whether that be by increasing the amount they spend via online media or offering a digital loyalty incentive scheme. Bain and Company have reported that attracting new customers will cost your company six-seven times more than keeping an existing customer.

As the chart with the article illustrates, the importance of existing clients should not be ignored.

An interesting example of a social impact project that is “up and running” is with Plastic Bank, in Haiti, which has been rewarding locals to collect plastic and then paying them with tokens. Further examples are illustrated in an article by Breaker Mag, which listed a selection of different organisations using Blockchain technology, and/or issuing tokens as part of “social impact for good” projects.

Nudge economics has also been widely adopted for years to encourage citizens to change their behaviour, e.g. putting seat belts in cars or giving you selection of dustbins to recycle your rubbish etc. So, offering tokens to change behaviour (i.e. retail loyalty schemes or potentially earning Libra coin for spending more time on Facebook) is really nothing new. We have also seen IoTA paying tokens to drivers of both Jaguar and Land Rovers in order to encourage them to share information about road conditions, traffic congestion, reason for the journey etc. However, whether using Blockchain technology and tokens to encourage these types of behaviour for social good is another story for another time!

CONCLUSION

The adoption of Blockchain technology and digital assets was initially being driven bottom-up—that is, by cyberpunks who wanted to bypass banks, those carrying out “dodgy deals” on the Silk Road and small tech start-up businesses. Increasingly, we are seeing more top-down advocates—governments, multinational corporations (such as Goldman Sachs, Allianz, SC Johnson and Facebook) implementing the technology to solve real business and environmental challenges. There is still need for a better infrastructure in order to trade digital assets and clearer guidance from regulators.

Then there is the question of quantum computers—will they be able to hack into the military-grade security that Blockchain technology currently uses?