Detailed investigation by a Canadian think tank shows that India, which imports one third of the world’s gold supply, is picking up the metal from Congo, a nation where gold mines are linked to corruption.

New Delhi: Do you know what is the Great Lakes Theory and why is it so, so important for India? If you don’t, ask officials of the Directorate of Revenue Intelligence (DRI) and Customs and they will tell you why: over the years, Indians have routinely sought gold from the mines of Congo, Somalia, Sudan and Uganda which travels through routes that lie close to Lake Victoria.

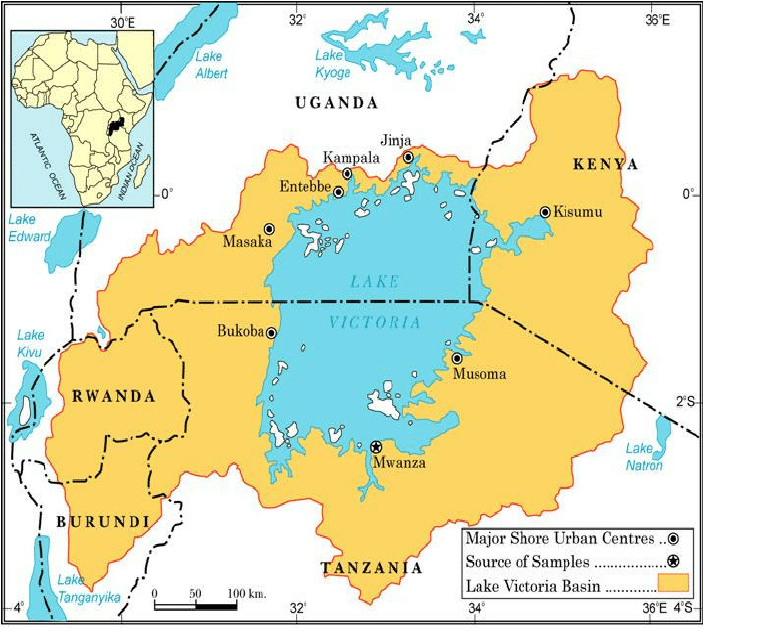

Stretching across a whopping 69,484 square km, Lake Victoria is also called Victoria Nyanza, the largest lake in Africa and the chief reservoir of the Nile, lying mainly in Tanzania and Uganda but bordering on Kenya. And it is through the routes of this lake scores of smugglers are picking up consignments of gold for the big Indian market that is among the world’s largest.

So who are these men? And how are they sourcing their yellow metal for India?

Detailed investigation by Impact, a Canadian think tank, shows India, which imports one third of the world’s gold supply, is picking up the metal from Congo, a nation where gold mines are linked to corruption. While some of the artisanally-mined gold is exported from Tanzania, the bulk of the gold travels through Uganda. The report, sourced by this reporter, says the biggest city in the region is Mwanza, a port on the southern coast of Lake Victoria that offers direct cargo service to Port Bell outside Kampala. The port also has direct road links with Kigoma, a town close to Lake Tanganyika from the mineral-rich Kivu Provinces that lie in the eastern parts of Congo.

Merchants of Indian origin use air and road links to Nairobi and then export the metal to the UAE and then to India. “Somewhere in the route, illegal gold turns legal.”

DRI officials in Delhi and Mumbai agree Indians are picking up gold from Mwanza, a town notorious for such illegal sales. The DRI officials agree that Indians have an edge in Mwanza because they pay top prices, much higher than the London Bullion Market prices. And then, the gold travels from Mwanza to Kampala, Nairobi, Zanzibar and Dar Es Salaam and then lands up straight in Dubai. And then, the gold goes through an interesting process in Dubai to turn legal and eventually lands up in India.

Consider the case of one Indian who is known as Patel, just Patel in Kampala. He is a refiner, says the report, and trades as much as 200 kg of gold every week. What is important to note that in 2017-18, as many as eight Indian refineries imported over 200 tonness of gold from Africa.

Among the top Indians, says the report, is also Sameer Bhimji, a controversial gold importer on the radar of India’s Enforcement Directorate (ED) for moving a little over 700 kg of gold from Uganda every week to Dubai for refining and eventual export to India. Bhimji has been raided several times and it is on record that he has links with one Prithviraj Kothari, popularly known as the Bullion King in Mumbai. The report further says the Kothari family’s Dubai operations are run by one Raju Kothari, a close associate of Bhimji.

DRI officials told this reporter that from Dubai, traders routinely direct illicit gold to Bangladesh, Bhutan, Nepal, Pakistan, Singapore and Thailand and the bulk of the supplies, eventually, land up in India. There are many advantages in sending gold to India, a nation which has borders with as many as five nations. Among the borders, the one with Bangladesh appears to be most porous and offers easy access to smugglers to reach Kolkata.

Once the gold is in India, there are hundreds and thousands of goldsmiths operating in more than 650,000 Indian villages who turn the gold bars for jewellery, and other use. So there ends the big search for gold.

“The Made in India plan was meant to encourage the local refinery sector, but it has now snowballed into a huge crisis because a large number of traders are sourcing gold from dubious sources. We just do not have the resources to check such supplies which are over 200 tonnes a year,” says the DRI official.

Thanks to this, surging gold prices are now becoming a major headache for the Central government, which agrees there have been huge unrecorded inflows after the government increased import taxes in July 2019 and prices surged to record highs in September 2019. Every day, Customs officials arrest people across the country for attempting to smuggle in gold by concealing it in bags, clothes and even rectums. In one such case in Chennai, Customs officials caught as many as 30 passengers, each trying to smuggle in 7.5 kg of gold.

The World Gold Council says the propensity to smuggle increases each time the taxes are hiked.

Gold in India touched a record high of Rs 39,885 per 10 grams in early September 2019 on higher import taxes. Besides, there was the US-China trade conflict and looser monetary policy which boosted global benchmark spot prices. As a result, bullion is still up 20% this year though it has retreated from its all-time high. Smuggled inflows of gold may jump 30% to 40% this year to 140 tonnes and rise more in 2020, estimates the All India Gem and Jewellery Domestic Council. It could also constitute a bigger percentage of India’s demand as official imports decline, rising to as much as 14% this year from 12% a year earlier.

A previous spate of smuggling occurred after India, which imports almost all of its gold, saw then Finance Minister P. Chidambaram increasing the tax three times in 2013. Illegal inflows peaked at 225 tonnes in 2014. In September and October this year, nearly 40% more gold was seized than the same period in 2018, mainly from China, Taiwan, Hong Kong, Myanmar and Dubai. “We have an increasing lot of smugglers. Every international traveller is trying to pick up some gold from the markets abroad and bring it through the normal route, saying it’s for personal use,” says the DRI official.

On 10 December, DRI officials arrested one Sahil Jain in Mumbai for illegally importing over 180 kg of gold in the last ten months. Jain, a 23-year-old gold merchant, said there were many, probably thousands like him, doing the same. This is a serious, serious crisis needing policy changes so that gold smuggling once again is denied the high profits that make smuggling so profitable.