India will continue to need labour intensive growth due to the imperative for employment for its labour.

Total Factor Productivity (TFP) is the increase in total production in an economy, in excess of the increase that would result from increase in factor inputs. This additional increase can result from intangible factors, like Technology, Health, Education, R&D, and other factors not directly attributable to labour, job skills or capital. It is one of the indicators of the efficiency in an economy, in converting inputs into productive output. TFP is best estimated over long periods of time and as percentage change.

The factors driving the TFP are not fully understood yet or quantifiable. It is estimated statistically, and does not have a theoretical explanation. It does not account for some qualitative changes. The richest person on earth did not have the intangible benefits of immediate connectivity in 1925, but the poor worldwide now have instant connections with friends and family. Some experts have reasoned that the stagnation of Technology from the mid-1990s to the mid-2010s has contributed to a reduction in the growth of TFP.For the mathematically inclined, TFP can be represented by the Cobb-Douglas function: Q = (TFP) x (Labour)a x (Capital)b, where Q is the total output, exponent a is the output elasticity of labour and exponent b is the elasticity of capital.

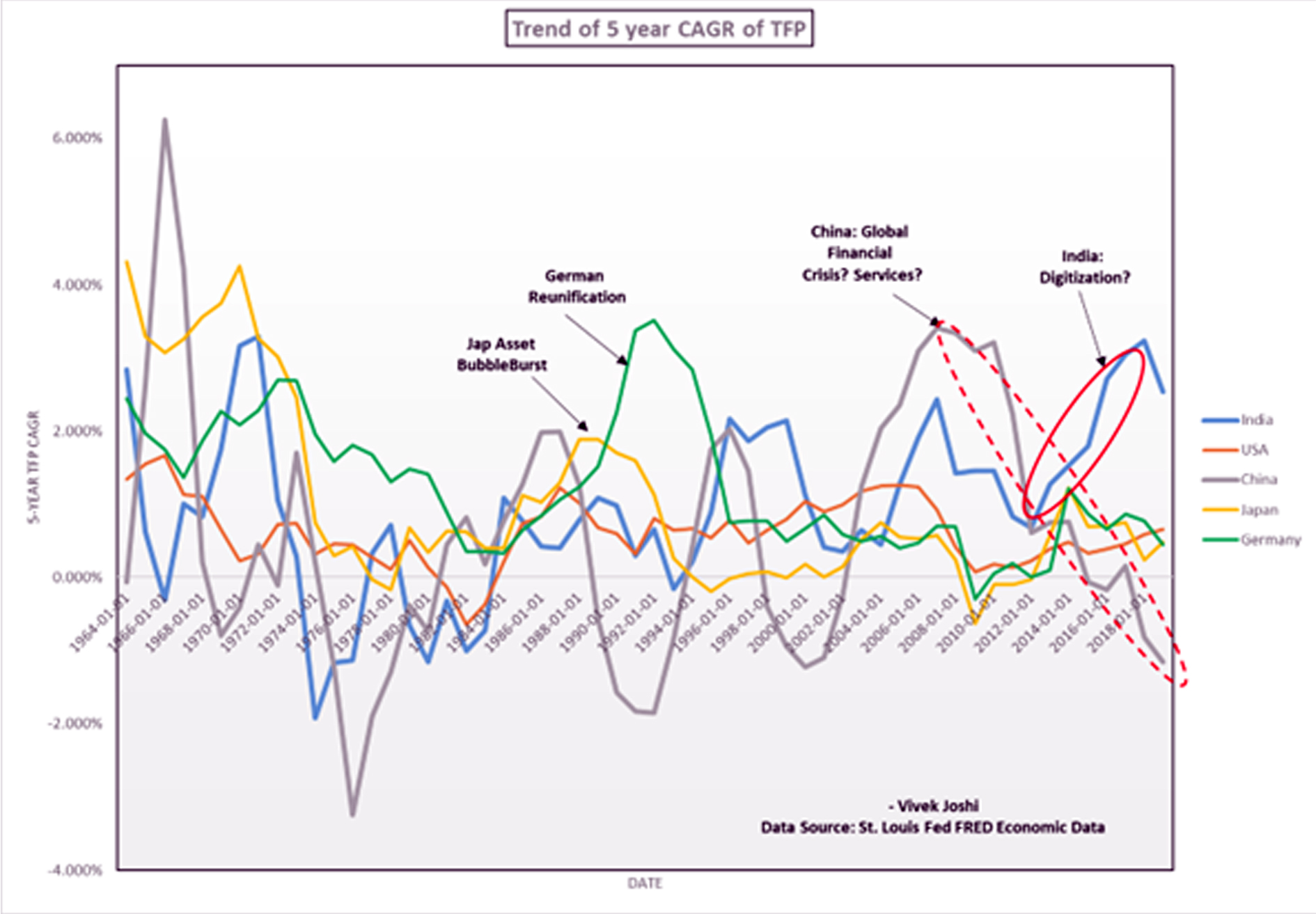

The first chart shows the trends of 5-year compounded average annual growth rate (CAGR) in TFP at constant national prices for five countries. Recent trends for China and India are highlighted. The data is accessed from the St Louis Fed Economic Data FRED (Ref1). Note that the data is indexed at 2017=1 for each country, and therefore absolute values or comparison of values across countries should not be interpreted from this chart. The data does not cover the period of the Covid pandemic, with its significant long-term and short-term disruptions. The arrows in the chart point towards major inflection points in the TFP trends and major macroeconomic event

The two subsequent charts show the change in TFP year-wise for India and China, and not the 5-year CAGR.

ANALYSIS OF TRENDS

TFP FOR INDIA:A noticeable increase in 5-year CAGR of TFP from 2013 is seen for India (blue line). Some of the underlying drivers of this increase could be:a)Thrust on Digitization in several aspects of the economy with resultant efficiencies.b)Baumol’s Effect, resulting from increasing emphasis on manufacturing, and therefore a proportionate reduction in role of lower productivity labour based services (and agriculture). However, it may be too early for the emphasis on manufacturing to show results. India will continue to need labour intensive growth due to the imperative for employment for its labour. Shift of labour from low productivity agriculture was seen before the Covid pandemic, but has reversed during the pandemic, probably temporarily. c)Higher enrolment ratios in colleges and senior levels in schools. This is also one of the reasons for the decrease in Labor Force Participation rates (LFPR).d)Employment elasticity of growth (Ref 2) has been decreasing for a long time. This can reflect in higher contributions by the other factors in the Cobb-Douglas equation shown above.e)Higher portion of outlays on MNREGA utilized for actual productive work. f)Low base of productivity to start with. g)Healthier and more skilled labour (upskilling programs).

TREND FOR CHINA:TFP plummeted during the disastrous “Great Leap Forward” and “Cultural Revolution” in the past, recovering as China liberalized. A noticeable downward trend is seen from the global financial crisis in 2009 (grey line). The reasons could be a)Rapid and excessive investments in infrastructure not yet yielding results. b)Sharp increase in debt levels in the economy. c)Shift towards a services led economy, with services overtaking industrials in 2008. d)Effects of an ageing population. e)Higher starting base as compared to that for India. f)LFPR for China has also decreased. Another common trend for China and India is a sharp fall in female LFPR for both countries in the past 30 years.

BENCHMARK WITH USA:While the trends for India and China, both emerging market economies, show steep ups and downs, the trend for the United States is “steadier and flatter”. It has a highly innovative economy among the five countries, and is better positioned.An open economy, innovation, immigration, political stability, strong commercial law enforcement and broad consistencies in policy making appear to support TFP.

The trends are positive and encouraging for India. It is important to emphasise that in terms of absolute productivity of labour and capital, India lags far behind the other countries discussed here. It is important that the trend in increase in TFP be maintained over long periods.The imperative to provide employment to a vast workforce runs counter to the need for higher productivity unless high and rapid growth of the economy is sustained. Managing these will be a challenge for a long time.

Reference 1: University of Groningen and University of California, Davis, Total Factor Productivity at Constant National Prices for United States [RTFPNAUSA632NRUG], retrieved from FRED, Federal Reserve Bank of St. Louis; February 20, 2022

Reference 2: “Employment Trend in India: A Review”, Vivek Joshi.

Vivek Joshi is an Advisor with A-Joshi Strategy Consultants Pvt Ltd, and has more than 25 years of international management experience.