In the aftermath of the Prime Minister’s call to clean out black money, when Niti Aayog tweets promoting the digital money solutions of a private company, should you be worried? Especially if this follows the Prime Minister’s call to usher integrity and honesty and appeal to every Indian for support?

Somewhere, the canvassing for digital platforms has diluted the Prime Minister’s bold call that countless were willing to stand in long queues for. It transformed the narrative of black money and shifted to going cashless and digital. The absence of any public discussion, debate or a policy document by the Niti Aayog, while promoting payment systems and digital platforms for transactions of private non-government companies, calls to question our ability to protect national interests and be free from private lobbies and conflicts of interest.

Does digital currency have no colour? Will it eliminate black money? Or is this simply an effort at making the people of India to link their bank accounts to UID and other digital platforms that will severely impact India’s banking system? Is it an attempted takeover by private interests of the Prime Minister’s narrative in order to create havens to hide black money digitally?

ONBOARDING -VIRTUAL ACCOUNTS

Strangely the argument for digital starts with the UID number. The UID is a random number allotted to demographic and biometric data submitted by private parties. It has never been verified or audited to confirm the identity, address or even existence of a real person associated with the number. This means that the existence of ghosts (non existing persons), fakes (real persons with fake identities) and duplicates cannot be denied. Using this number as the basis to open bank accounts, as enabled by the Reserve Bank of India (RBI) in January 2011, onboards virtual customers. The use of the UID number as the basis for KYC, therefore, allows the creation of bank accounts for ghosts, fakes and duplicates.

For sceptics who believe biometrics will prevent such a scenario, there is no compulsion for biometrics to be used in the process of onboarding a customer in a bank. Even if it were required, there is no verification or audit of the biometric ever having happened. Furthermore, if it was the biometric that uniquely identified you, making it the safest identifier, why would your UID number ever be needed to query the UIDAI database? Your biometric would have been the sole requirement to open your bank account, not your UID number.

UID based eKYC, or remotely accessing information associated with an UID number as KYC, enables the creation of bank accounts without physical presence of any individual. According to the UIDAI, eKYC brings scale to the ease of onboarding customers. eKYC too was allowed by the RBI in 2012 after having raised serious concerns and offering a spirited resistance.

The UIDAI eKYC procedures require that no data is kept by those initiating the eKYC other than the response from UIDAI. This response from the UIDAI is to be kept for at least six months for audit purposes. The complex network of agencies providing eKYC, the absence of audit processes being in place and the complete absence of permanent record of customer information leave no means to verify and audit the existence of real persons in whose name millions of bank accounts may have been opened.

Bank accounts opened solely with the UID number or with documents obtained on the basis of an UID number are indistinguishable from mule accounts, or accounts that are controlled by third parties for the purposes of money laundering. Those in control of such bank accounts can, therefore, use them to distribute income and accumulate black wealth to keep it out of the tax radar.

The orders of August 2015 of the Supreme Court of India actually make linking, seeding or even doing a eKYC with UID numbers illegal. The RBI has, however, yet to notify the banks and payment systems operators to discontinue and disconnect the use of the UID number in banking operations. The failure to take cognisance of the Supreme Court’s orders and even issue a simple notification prohibiting the use of the UID number in banking is disregard and disrespect of the rule of law and contempt of the Supreme Court’s orders.

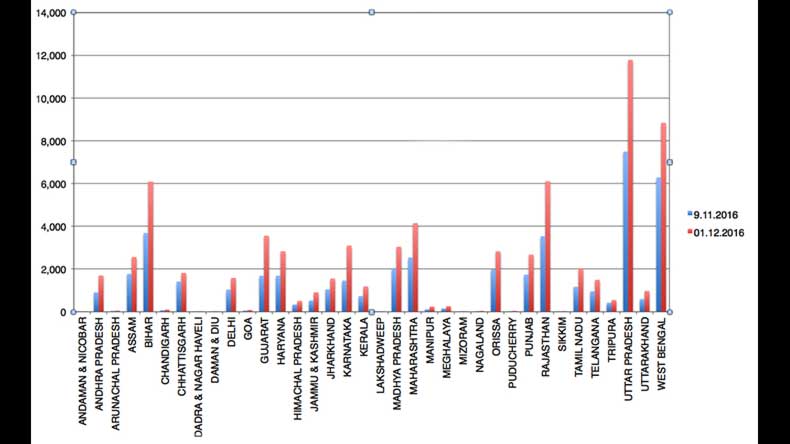

Jan Dhan bank accounts are the tip of the iceberg in terms of bank accounts opened with UID as the sole KYC. However, they are visible as a category of accounts opened solely with UID. 76% of Jan Dhan accounts were zero balance till one rupee was added to many accounts to bring down zero balance accounts to 23% so that the concentration of money deposits would not be noticed. There has been a rise Rs 32,000 crore in Jan Dhan deposits in the two weeks since demonetisation. The RBI does not publish statistics of the number of accounts with balances more than Rs 5,000…25,000, 35,000 and 45,000. If it did, it may tell some stories.

ANONYMISING MONEY TRANSFERS

When you link your UID number to your bank accounts, your bank seeds it with the National Payments Corporation of India (NPCI), a non government Section 8 company under the Companies Act. The NPCI overwrites the account number associated with your UID with the latest account number you associated with your UID number. If you received money into your SBI account seeded with your UID number and later linked your HDFC account with your UID number, you have made the money transfer untraceable. This can allow multiple accounts to receive money without being traceable by simply associating them transiently with the same UID number.

When you create a Virtual Payment Address (VPA) using NPCI’s Unified Payment Interface (UPI), you anonymise your money transfers. Using the VPA your transactions will not reveal your account number to the parties receiving your payments. So money you transfer from your VPA to yourself (or any other person) cannot be traced back to you.

Mobile wallets allow you to receive money into your mobile wallet account. Mobile wallets need a mobile number. As long as you can obtain SIM cards you can charge each with up to Rs 10,000 without needing to do any KYC and Rs 100,000 if you do a KYC. If your mobile number doesn’t identify you, your money transfers will not be traced back to you. If you used a ghost, fake, duplicate or third persons UID number to obtain a SIM card, it does not trace back to you. Unfortunately, TRAIz has been using UID numbers to do KYC for issuing SIM cards.

GENERATING, PARKING BLACK

Anonymous or untraceable money transfers are considered by bankers as money laundering. Money laundering is used to deposit or transfer black money that may have arisen from corruption, illegal trade or avoidance of tax during transactions.

Digital platforms that anonymise the payments made into bank accounts, accumulate black wealth and hide black income. These platforms allow the income to stay out of the tax radar as it is distributed across multiple bank accounts linked with different identities. These platforms accumulate black wealth as they store the operators’ black income and make it indistinguishable from white money in other bank accounts.

Digital platforms offer masking, scale, automation and remote operations, something cash cannot ever provide. It is, therefore, a dream come true for black money hoarders, terrorists and organised criminals. The combination of virtual accounts and anonymising

money transfers creates unprecedented opportunity to launder and hide black money.

Going digital, therefore, does not enforce the Prevention of Money Laundering Act or do away with the responsibilities under the Payment and Settlement Systems Act. It does not automatically ensure that the provisions of the Income Tax Act, Central Excise Act, Central Sales Tax, Customs Act, Service Tax Act, Value Added Tax acts, Property Tax Acts, Road Tax, Toll Tax etc are complied. It does not eliminate black money.

WHAT CAN –GOVERNMENT DO?

Firstly, the government needs to eliminate virtual or benaami accounts. All UID based accounts need to be frozen till they can be confirmed as legitimate accounts of real people through pre-UID KYC with no ID or address proof obtained by using UID numbers. Next, the government needs to end all payment and settlement systems, digital wallets and payment interfaces that create virtual addresses or anonymise the payer or payee. Digital transfers should be through NEFT or RTGS.

Digital should be a choice of the citizen, the consumer and not a state dictate. Eliminating the choice is exclusion of those who cannot or do not wish to be digital. In a country with 70% people living in rural India, 95% of who are unbanked, and less than 9% of who have access to internet, digital banking is exclusion of the people. Even in urban India, mobiles experience call drops, their data plans don’t work, the complaints don’t get addressed. Furthermore, there is no inherent virtue in being digital, nor a constitutional requirement to become a digital republic.

The success of the Prime Minister’s call for honesty and integrity hinges on ensuring the government actually has a think tank to see alternate scenarios, before the brash and expensive policies pushed by bureaucracy in collusion with private interests are implemented. It hinges on ensuring government committees are not filled with persons with conflicts of interest, those who lack a public mindset and those who do not understand national interest. It rests on ensuring respect for the rule of law, the respect for orders of the Supreme Court of India and its orders. It hinges on a policy of governance that is driven by the purposes of enabling fulfilling lives for all and not mere digitisation or automation of their lives. It rests on revising government processes to build trusting relationships with citizens and tracking and auditing the government’s implementation of its budget and programmes, not people’s expenditure on living their lives. It hinges on replacing a ruling bureaucracy with people’s public service, where every person serves in the government for at least three years of their life.

Prime Minister Narendra Modi has the confidence of the nation to change systems and deliver honesty and integrity in government before the New Year as promised by him on 8 November 2016.

Dr Anupam Saraph is a Professor, Future Designer, former governance and IT adviser to former Goa Chief Minister Manohar Parrikar and the Global Agenda Councils of the World Economic Forum.