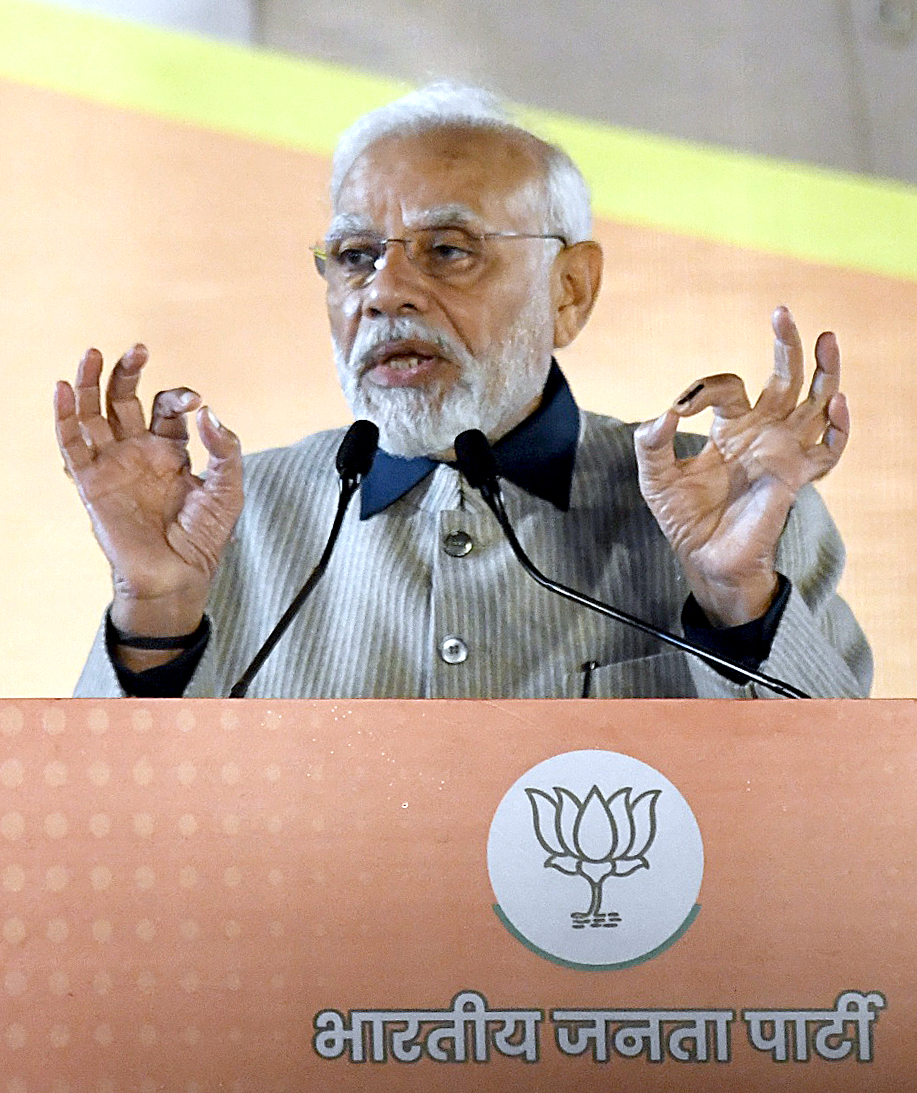

People trust PM Modi for his integrity and hard work, and these are the attributes needed to propel the financial sector in India to rapidly become a much bigger contributor to GDP than agriculture.

Once he became Prime Minister of India, Narendra Modi initiated a raft of measures that brought hundreds of millions of citizens into the formal banking network. Into the new accounts flowed subsidies without the customary middleman’s cut. Since 2019 in particular, several of the irksome “Bribe Creator” regulations and laws that had lingered for decades have been pruned away by PM Modi, with more to follow. Given such a trajectory, it is only a matter of time before GST rates get lowered and applicability gets further rationalised. The GST structure acting as a booster of the rate of growth is the best path towards a consistent and significant increase in revenue. Given that the Finance Ministry is showing a much greater zeal for reform in Modi 2.0, public expectation is high that the coming Union Budget will see a reduction in tax rates so that tens of millions more citizens voluntarily sign on to the family of taxpayers. Finance Minister N. Sitharaman has worked hard to ensure that tax harassment gets reduced, and such a change in the chemistry of tax officials from being policemen in civilian dress to acting as friends of the taxpayer is visible on the ground.

President Biden and his UK and EU partners, by their actions following the invasion of Ukraine by Russian forces in 2022, have made the financial primacy of the US, EU and the UK vulnerable. The London Metal Exchange (LME) has till now been the dominant player in the pricing of commodities, from gold to copper, just as the CME (Chicago Mercantile Exchange) has been for a huge chunk of global mergers and acquisitions. Working in tandem with the CME is the Nasdaq and the NYSE, which together form the trio that gives Washington a chokehold on the global marketplace. As a consequence of the Russia-related sanctions and the fuelling through NATO armaments of the Russia-Ukraine war, global trust in these institutions being independent of temporary geopolitical considerations has been substantially reduced from the already lower base caused by the 2008 financial meltdown. This was caused by the greed of a few US, UK, Swiss and EU bankers and traders to profit no matter what the cost to society, especially in third countries. President W.J. Clinton and President George W. Bush oversaw a slashing of legal barriers erected to prevent unethical financial trades. If today is the turn of oligarchs whose only crime is that they are ethnic Russians to be deprived of their assets without due process, tomorrow it may be the turn of the Saudis or the citizens of Qatar. Such quirky, indeed thoughtless, behaviour has highlighted the need for new finance and commodity platforms not beholden to western chancelleries in the way those located in the US,UK or the EU are.

During the period in office