India is not yet in a position to manage the consequences of the INR becoming a reserve currency.

Recent geopolitical events and weaponization of the financial system have highlighted the importance of Geoeconomics, which is a form of power like geopolitical and military power. It can be defined as use of economic instruments to further geopolitical and national interests. These instruments can be trade, investments, policies (monetary/financial), aid, energy, commodities, cyber, sanctions and Sovereign Wealth Funds (SWF). This article examines factors which could determine whether a currency can be a global reserve currency, the major candidates, and implications.

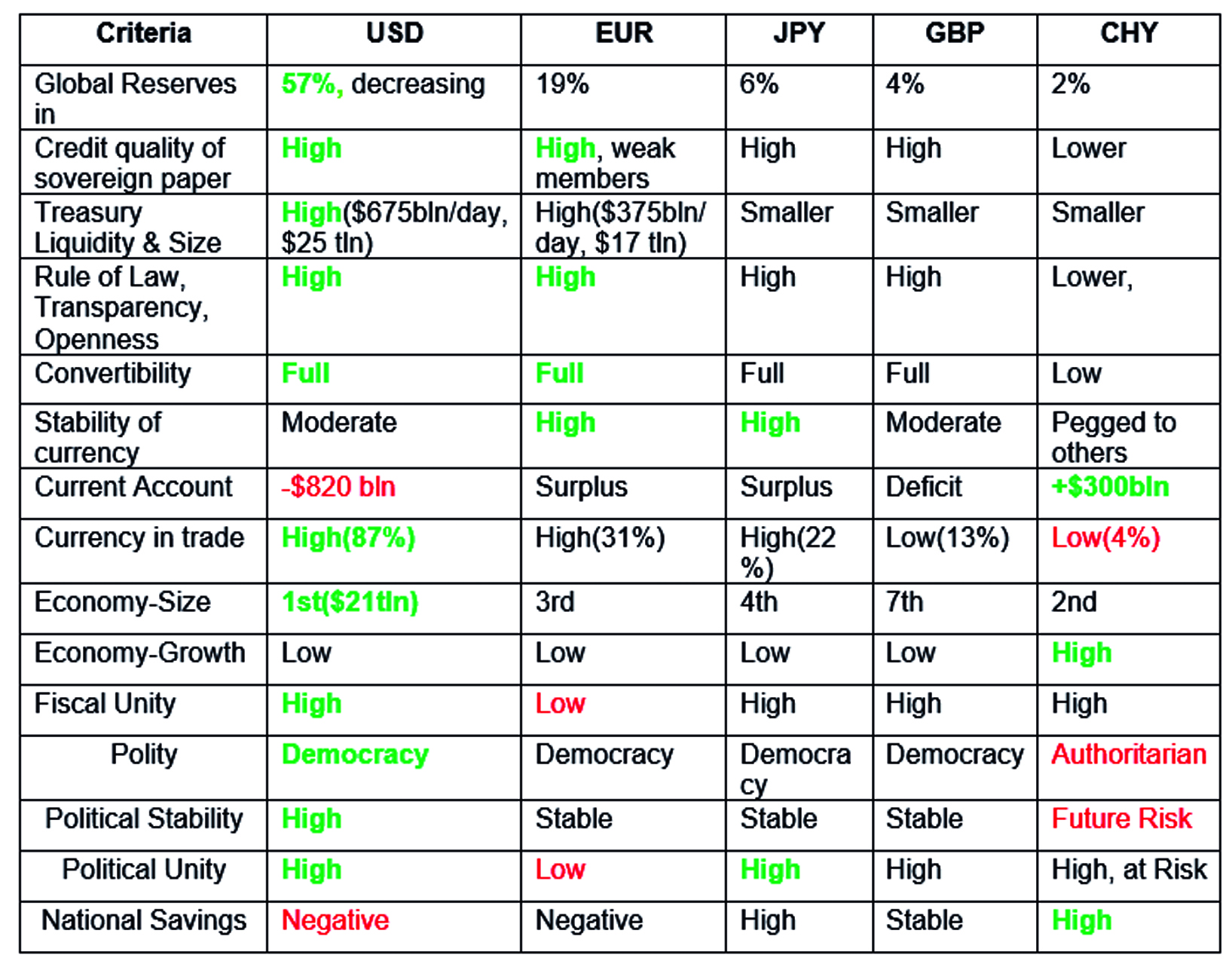

A credible currency needs to be (a) stable (b) safe (c) store of value (d) medium of exchange (e) widely accepted and (f) trusted. Additional criteria for a global reserve currency are: (a) Features and stability of the political system of issuing country (structure, processes and institutions) (b) Quality of institutions and processes; (c) Size and prospects of the Economy; (d) Integration of markets and economy globally; (e) Transparent, open system which can withstand the impact of the “unholy trinity of macroeconomics”; (f) Credible legal system and rule of law; (g) Quality of issue of the sovereign; (h) Ability to bear costs associated with issue and management of a reserve currency, and (i) Size, depth and liquidity of markets.

Five major currencies are compared using these criteria, with focus on the two leading contenders—the US Dollar and Euro. India is not yet in a position to manage the consequences of the INR becoming a reserve currency. Currency leading the pack for a specific criterion is highlighted in green colour, and a strong negative factor is highlighted in red.

DIGITAL CURRENCY

Cryptocurrencies do not meet several of the criteria due to the wide fluctuations in their values benchmarked against currencies. A South American country has faced serious difficulties as part of its reserves were held in cryptocurrencies which lost value recently. A currency being the 2nd area in which a state has monopoly (organized violence within its borders is first), states will not give up control over currencies. Central bank digital currency (CBDC) is legal tender issued by a central bank in a digital form, and is a digital twin of the paper based fiat currency. Several countries are planning CBDCs which will be more efficient, less expensive, transparent, and secure. Digital currency twins will face the same challenges in meeting the requirements for a global reserve currency. A number of countries together can possibly design a digital currency for a part of mutual trade and even reserves. Such a common digital currency can benchmark its value to a combination of global currencies including the USD without using the USD and avoiding “touching” USA in transactions, which has been cited as a reason for secondary sanctions. Such cooperation will require high levels of mutual trust and transparency in addition to meeting underlying financial & economic requirements. For example, BRICS bank can have a BRICS digital currency for interactions among members, but India will be very uncomfortable if China has large holdings of a currency which can be used in India, and relationships with Russia can now invite secondary sanctions.

SDR & Gold

Special drawing rights (SDRs) are a form of reserve currency issued by IMF, and their value is derived from a basket of currencies. Apart from limitations due to the issuer itself, their quantity, distribution and allocation is a challenge, and their use as a reserve currency is limited. Gold can be the basis of a currency, but its stock is limited, its value needs to be benchmarked and it will have limitations in very wide use as a medium of exchange. Gold based digital currency supported by states (sovereigns) can become a limited reserve currency.

Implications

The analysis incorporating criteria and candidates shows that the US dollar followed by the Euro will continue to dominate as reserve currencies. This position is an important enabler for use of several of the geoeconomic instruments mentioned earlier. These two currencies (& GBP) are also in the same geopolitical club and very often act in concert. The two principal international economic bodies, World Bank (USA) and IMF (Europe) which were created at Bretton Woods in 1944 are controlled by the issuers of the same currencies. Infrastructure like satellites and undersea cables which are critical for the use of a digital currency are also effectively controlled by them. Aligned with dominance over reserve currencies is control over transactions through SWIFT, and alternatives like CIPS (China), SFMS (India), SPFS (Russia) and IndiaStack are too small, and have their own implications. These are serious geoeconomic issues for other countries. History of empires suggests that long term geopolitical dominance is enabled more by good financial management than by military means

Asia has the largest population, highest share in world trade, plentiful resources, combined economy larger than that of Europe, and powerful militaries. China or perhaps Japan is the centre of gravity of Asia, however, China alarms others due to its coercive & transactional approach, and Japan does not have a fully independent foreign policy. Asia remains geopolitically very vulnerable due to weak geoeconomic power, in part due to domination of reserve currencies by others. Economic growth by itself is not enough for geoeconomic power, which will require coexistence & cooperation (not coercion), institutions and statesmanship in Asia.

Vivek Joshi is an Advisor with A-Joshi Strategy Consultants Pvt Ltd, and has more than 25 years of international management experience.