London and the UK are at the centre of inward investment in Europe. London property has so much investment from foreign countries that proposals are being mooted to monitor foreign purchases.

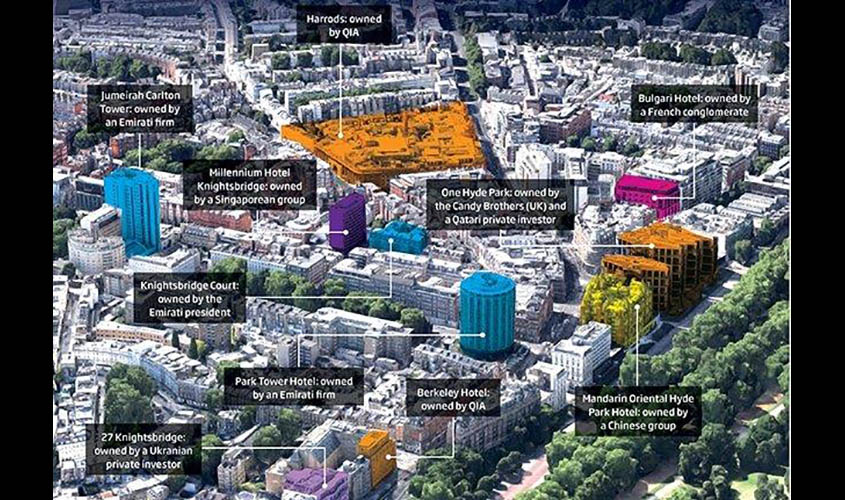

London ranks top for culture, accessibility, transport links and tourism, the capital attracts primarily Middle Eastern and Chinese investors. A cursory look at Property Week shows that the Qatari Investment Authority, Qatari Holding and Qatari Diar own 23,253,699 square feet of London, making Qatar the largest owner of London property. Reports vary about the sum invested, alleged to be £35 billion. Qatar’s square footage is more than HM The Queen’s Crown Estate, which ranks sixth in Datscha’s Property Ownership 100 List, just below BNP Paribas. The Qatar properties include the Olympic Village, the Shard, Claridges Hotel, the Park Lane Inter-Continental Hotel, the Berkeley Hotel, the Connaught Hotel, Harrods and the site of Chelsea Barracks and a stake-holding alongside the Canadian company Brookfield in the Canary Wharf Group. Qatar also holds 20% of the London Stock Exchange. Sheikh Hamad bin Jassim bin Al Thani and the Candy brothers co-operated on the developing of Number 1 Hyde Park, London’s most expensive apartments, and in November 2016, Qatari Diar secured a resolution to grant planning permission from Westminster City Council for the redevelopment of the US embassy in Grosvenor Square into a hotel and retail elements. The new fortified US embassy is moving to Battersea, south of the river Thames.

Liam Fox, UK Secretary of State for Internal trade, told CNN recently, “It is no exaggeration to say that, through these ventures, Qatar has become a part of the fabric of our nation.” Real estate is not the only stock. Qatar rescued Barclays Bank from a government bailout in 2008, reputedly infusing $6.1 billion. Qatar has a 6% holding in the bank. This month, Barclays plc and the four senior bankers who raised the capital with Qatar were charged by the Serious Fraud Office with conspiracy to commit fraud. The case rests around two false misrepresentations related to raising capital and a US$3 billion loan facility made available to Qatar, acting through the Ministry of Economy and Finance, classified as unlawful financial

The government of Kuwait enters at number 16, with 3,646,359 square feet, three places above Britain’s largest private landowner, the Grosvenor Estate. Kuwait has its UK property investment vehicle in St Martins. Kuwaiti properties include City Airport and City Hall, the headquarters of the Mayor of London Sadiq Khan. The Bahrain investment firm, Mumtalakat acquired last year a stake in UK’s water firm Envirogen. Recently, Sheikh Mohammed bin Essa al Khalifa of Bahrain has become the chairman of the MacLaren Technology and Automotive Group.

Saudi Arabia’s IOP of 5% listing of Aramco’s shares are believed to be launched at London’s Stock Exchange, but Crown Prince Mohammad bin Salman has yet to confirm. The historic sale is expected to raise US$100 billion; facilitated by the Financial Conduct Authority launching proposals to create a new category within its premium listing regime to cater for companies controlled by a shareholder that is a sovereign country. The FCA changes are designed to reflect London’s appeal to state-controlled firms in GCC countries, considering listing oil assets. It is said that the Gulf states control more than $208 billion worth of investments in the UK.

The Church of England feature at number 87, with 1,075,466 sqft of London, only just above Walmart. Individuals from the Emirates, Iraq, Iran, Syria, Egypt, Lebanon and Sudan all have commercial, business and private investments in the UK, crossing the sectors of property, oil, gas, metal, consumables and telecoms. Many of these individuals also benefit charities and political parties with their generosity.

Despite the uncertainty presented by Brexit, Middle-Eastern and Far-Eastern buyers are now active out of London.

Chinese investment too flows into Britain. In 2016, a DealGlobe/Hurun report from Shanghai claims that deals made in UK had an aggregate value of $216 billion, up from $87 billion in 2015. A Cass Business Study reveals that the deal volume of Chinese cross border M&A into the UK hit a record high in 2016. According to China Global Investment Tracker, Chinese investments and contracts in Britain during 2017 will be worth $2.84 billion, with Savills reporting Chinese investors accounting for 96% (£805million) of West End investment in January 2017. In February, CC Land acquired the Leadenhall “Cheesegrater” building for £1.15 billion and in July the Hong Kong Group LKK purchased 20 Fenchurch Street, the Walkie-Talkie building, for a record £1.3 billion. Other Chinese property investments are in Chiswick Park and Canary Wharf. State and private Chinese investors find UK real estate and infrastructure very attractive. The 2016 Hinckley Point nuclear project with French energy firm EDF gave a China a 33% stake and the Chinese are hoping for a further part to play in other reactors planned in Suffolk and Essex. Presently, some Chinese portfolio includes percentages of Rio Tinto (aluminium), Barclays Bank, Global Switch (data Storage), BP and Talisman Energy, Heathrow and Manchester (airports), Felixstowe Port, Thames Water-Northumbrian Water-Veolia Water, many retailers/including travel operators and consumer brands. New sectors said to stimulate Chinese investment are Fintech, media and creative industries, renewable energy, life sciences and telecoms. Football clubs are also fashionable acquisitions, with Chinese, Thai, Malaysian, Indonesian and Indians featuring in the ownership stakes.

Despite the uncertainty presented by Brexit, Middle-Eastern and Far-Eastern buyers are now active out of London. The relatively untapped property markets of Reading, Portsmouth and Liverpool areas are being added to Manchester and Birmingham assets. Analysts expect further interest in the London property market to come from investors based in Japan, Singapore, South Korea, Germany and South Africa.

John Hemmings from the International Relations Department at the London School of Economics recently published a paper for the Lowy Institute about the surge of Chinese investment and influence in Western liberal democracies. It seems Chinese investment into global technology sectors of commerce and infrastructure is reaching epic proportions. Following Berlin’s lead to restrict Chinese investment into Germany’s digital economy and the establishment of the US’ Committee for Foreign Investment and Australia’s Foreign Investment Review Board, Hemmings recommends balancing Beijing’s industrial and investment goals with an assessment system to safeguard British strategic assets. Hemmings concludes that it’s “time for Five Eyes to co-ordinate on Chinese investment”.