India’s automobile industry’s wholesales in March 2024 of passenger vehicles grew 10 per cent, two-wheelers were up 20 per cent while sales of medium and heavy commercial vehicles dipped 11 per cent and that of tractors went down 22 per cent. The miss was mainly in Mahindra across auto and tactors along with Honda Motors and TVS. For FY24, retail growth of M&M, Tata Motors, Bajaj Auto and TVS was ahead of their respective industry, shows the Nomura Global Markets Research of April 2024.

The report estimates domestic PV industry

In the PV segment, Maruti Suzuki’s domestic sales volumes were at 153000, up15 per cent yoy. Nomura estimates MSIL’s retail growth to be in low-single-digit with channel filling of 8-10000 and estimates MSIL’s wholesale market share at 41 per cent. “With commodity and forex tailwinds and higher wholesales than retails, we estimate MSIL’s margins can see strong expansion in 4QFY24F,” says the Nomura report.

Passenger vehicle sales in India are projected to set a record in FY24 with over 4.2 million units sold supported by strong growth in SUV sales, according to Shailesh Chandra, Managing Director, Tata Motors PVs and Tata Passenger Electric Mobility. “With sales of cars powered by traditional fuels (petrol and diesel) flattening, almost the entire incremental volume growth of FY24 is expected from rising sales of emission-friendly powertrains. “EV and CNG segments are projected to post robust growth of 70 per cent and 55 per cent respectively in FY24 vs FY23, on the back of multiple new launches, growing charging infrastructure and CNG stations, significantly lower operating costs and growing consciousness among customers to be environment friendly,” says Chandra.

Hyundai Motor India registered its highest ever total sales of 7,77,876 units in FY23-24 with a yoy growth of 8.0 per cent and the highest ever domestic sales since inception of 6,14,721 units in FY24 backed by robust demand for its products in India. “In the domestic market, HMIL sales surged by 8.3 per cent in 2023-24 against the previous year. These are the highest sales reported by HMIL since inception,” says Tarun Garg, COO, HMIL. Export for the year stood at 1,63,155 units with 6.7 per cent growth over last year. In the month of March 2024, the company reported total sales of 65 601 units including 53,001 units in domestic market and 12, 600 units of exports.

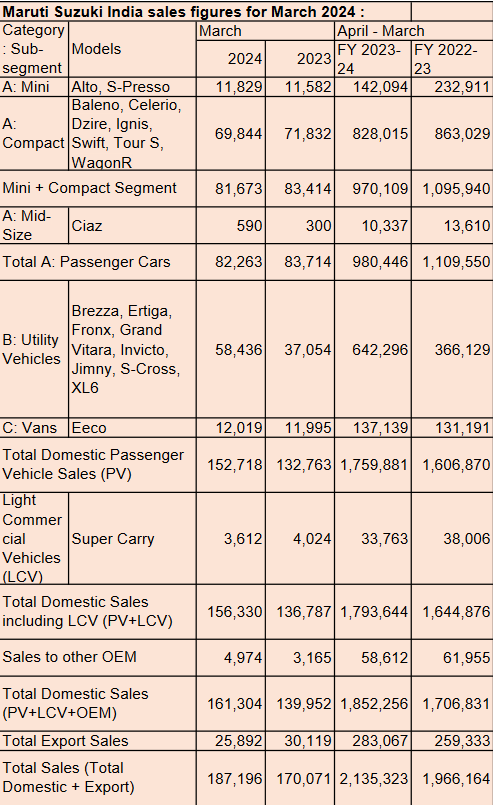

Maruti Suzuki which attained cumulative production of over 3 crore units at the company’s Manesar and Hansalpur (Gujarat) manufacturing facilities, said that Indian operations are the fastest to achieve this feat among all Suzuki production bases in record 40 years and 4 months, since start of production in December 1983. In March 2024, the automaker sold a total of 187,196 units. Total sales in the month include domestic sales of 156,330 units, sales to other OEM of 4,974 units and exports of 25,892 units. For FY2023-24, the company posted its highest ever total sales of 2,135,323 units including highest ever domestic sales of 1,793,644 units and highest ever exports of 283,067 units.

“Over these years, we have been able to maximize production with steady support of our agile workforce and value chain partners who have helped us manufacture products in line with customer needs,” says Hisashi Takeuchi, Managing Director & CEO, MSIL. We remain committed towards ‘Make in India’ and have been strengthening our operations in the country, catering to domestic as well as global markets. We contribute nearly 40 per cent to total vehicle exports from India,” added Takeuchi. With its emergence as world’s third largest passenger vehicle market and poised to grow stronger in coming years, Maruti plans to invest further and increase annual production capacity to 4 million units by FY 2030-31. “Working towards this, we will set up two new green field manufacturing plants of 10 lakh capacity each at Kharkhoda-Haryana and Gujarat. We will also enhance our range of models from present 18 to 28 by FY 2030-31,” he added.

Toyota Kirloskar Motor (TKM) maintained its sales momentum, achieving new milestones in both fiscal year performance and monthly wholesales. “We are thrilled to close both our wholesales for 2023-24 fiscal year and March 2024 by recording the highest ever units of 2,63,512 and 27,180 respectively. Furthermore, instrumental to our growth has been our strong product portfolio, tailormade value-added services such as enhanced digitalization, financial tie-ups, high value proposition, easy accessibility to our products/services that continue to deliver awesome experiences to our increasing customer base,” says Sabari Manohar – Vice President.

In FY24, Tata Motors PVs (including EVs), posted its third consecutive year of highest ever sales with wholesales of 5,73,495 units (up 6 per cent vs FY23) and retail sales growing around 10 per cent vs FY23 (Vahan-based). “Although, no new nameplate was launched, our unique multi-powertrain strategy enabled us to deliver healthy growth with vehicles powered by CNG and EV contributing nearly 29 per cent of overall sales. In CNG, our portfolio of four products with innovative twin-cylinder technology, grew over 120 per cent vs FY23. The preference for Tata.ev products across both personal and fleet segments continued to grow and further strengthened our leadership in this segment with sales of 73,833 units and registering a strong 48% growth vs FY23,” noted Chandra.

In Q4FY24, Tata Motors PVs (including EVs) recorded its highest ever wholesales of 1,55,651 units, registering a growth of 15 per cent vs Q4FY23. Going forward, Chandra expects the demand for passenger cars to remain strong, although the high base effect may keep the growth rate in single digit.

Customers’ rising preference for safe and green vehicles should result in double digit growth for sale of cars with emission-friendly powertrains supported by new launches and a stronger value proposition – emission-friendly, lower total cost of ownership and equipped with smarter features.”