NEW DELHI: Some analysts see RBI action in the context of international economic turbulence and geopolitical developments.

Strength and confidence of the Indian economy to manage its own assets may have been a prime consideration for the Reserve Bank of India’s move to transfer 100 tonnes, or 1 lakh kilograms of gold from the United Kingdom back to its vaults in India. “It is a bold step underlined by the intent to shift more of the yellow precious metal in the coming months and signals the self assuredness of the Government in the economy and its own ability to take charge of its gold reserves,” D.K. Aggarwal, Chairman & MD, SMC Capitals Limited, told the Sunday Guardian.

Moreover, India now has the ability of safekeeping of assets and by bringing the gold back home, the RBI aims to enhance its control over the precious metal and ensure efficient management within its own vaults, according to Amit Goel, Co-Founder of Pace 360, a SEBI registered portfolio management service provider. “This recent move signifies a shift away from that historical decision and reflects the RBI’s evolving approach to managing its gold reserves,” Goel told The Sunday Guardian.

“Why to keep gold out when we have the storage and infrastructure to keep it in India,” reasons Aggarwal. “There is space in the RBI building in Mumbai and in Nagpur. By bringing back a part of its gold reserves, the RBI can save on these expenses instead of paying the Bank of England,” he adds. Aggarwal also points to a logistic cost attached to the transfer of gold. Initially, the RBI obtained an import duty exemption to bring the metal into the country. However, there was no exemption from integrated GST (IGST), which is applied to imports, since this tax is shared with the states, according to the SMC Capitals CMD.

“Central banks, including the RBI, hold gold as part of their foreign exchange reserves. Diversifying assets helps mitigate risks associated with inflation and currency fluctuations. By increasing its domestic gold holdings, the RBI strengthens its risk management strategy,” Amit Goel, Co-Founder of Pace 360, a SEBI registered portfolio management service provider told the Sunday Guardian. Recently India’s appetite for overseas holding of gold has been increasing. “As of 31 March, 2024, the Central Bank had 822.10 tonnes of gold in its foreign exchange reserves, according to the RBI’s annual data. Compared to 794.63 tons stored during the same period last year, this was an increase,” says Goel.

While this is indeed the first time since 1991 that India has moved such a heavy scale of gold — pressed as it was, way back then, to pledge part of its gold reserves amidst a foreign exchange crisis and severe criticism—experts told The Sunday Guardian that there is a need to delink from the precedence as the circumstances have undergone a sea change. “In order to address the balance of payments issue, specifically, between 4-18 July, 1991, the central bank

Cut to circa 2024, there has been a volte face in India’s economic stature wherein strong macro fundamentals put India in a position of strength from where the RBI sees little rationale in keeping gold stocked away in the UK’s Bank of England. A key indicator of India’s resilience is India’s robust forex reserves, at USD 646 billion as per recent data. “India’s forex reserves are displaying great resilience since the last many quarters,” agrees Sanjeev Agrawal, President, PHD Chamber of Commerce and Industry. The recent data shows that India’s forex reserves bolstered by strong economic growth trajectory, attractiveness to international investors and robust export growth trajectory. The robust GDP growth of 8.2 per cent for FY2023-24 will further strengthen the forex position of India,” observes Agrawal.

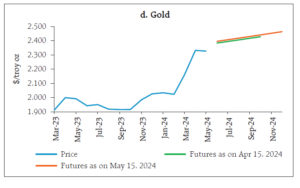

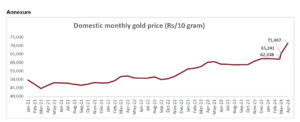

Some analysts also suggest that the RBI actions be seen in the context of international economic turbulence and geopolitical developments, including sanctions on Russia following the outbreak of the Ukraine war which led to freezing of its assets. Though such a situation does not apply in the Indian scenario, there may have been an underlying consideration of moving the gold back to India and keep the assets in the country. Incidentally, the RBI in its state of the economy report on 21 May 2024, cautions that heightened global uncertainty was sending emerging market central banks on a spree of gold buying, adding 290 tonnes in the first quarter of 2024 and accounting for a quarter of overall global gold demand. Amidst geopolitical developments and a slowing global economy, the RBI noted that these central banks were signalling that living in challenging times calls for strategic diversification.