The billionaires advocated an exponential increase in cashless transaction and demonetisation to the PMO.

Demonetisation rarely features in history, and most currencies are never delegalised or delegitimised, even those that are the targets of counterfeiting, as the US dollar is. Despite Japan’s advanced technological development, most consumer financial transactions today utilise paper currency, even though Japan is among the leading economic powers of the world. Indeed, when India’s National Disaster Response Force served in Onagawa, Japan, following the horrific earthquake and tsunami of 2011, amidst the debris of wrecked houses and bodies, the NDRF personnel found wads of Yen currency that were then handed over to local authorities. Japan is now attempting to move part of the current 80% of transactions that are in cash to cashless through incentives, not by any capricious decree. Therefore, while the comprehensive explanations in hindsight are still awaited on why Prime Minister Narendra Modi undertook that fateful decision of his, to demonetise 86% of all cash in circulation with just four hours’ notice, and then the abrupt demonetisation was followed by widely reported shoddy implementation, we can examine other cases in history and the resulting impacts.

Demonetisation occurred in the USSR, Ghana, Nigeria, Myanmar, North Korea and Zimbabwe—all countries beset with hyper-inflation and with appalling economic mismanagement in the periods concerned that have had military or quasi-military regimes interspersed with pseudo-democratic governments. In two cases, the demonetisation of Nigerian currency in the middle of the civil war, and the demonetisation of the dollar-denominated military yen currency issued by the Japanese Imperial Government in countries like Malaya from which the British, Dutch and French colonialists had been expelled, after the end of World War II, both were explicit consequences of military conflicts.

The breakaway secessionist State of Biafra from Nigeria existed from 1967 to 1970. It was among the first televised civil wars, with massive starvation and every type of atrocity including mass civilian executions, rape and looting making so profound an impact that many started to question the very modus operandi of UN and non-UN multilaterals such as the International Committee of the Red Cross that generally are able to work only with national governments, not breakaway states. Indeed, the humanitarian organisation Médecins Sans Frontières (Doctors Without Borders) was created by medical students in response to the prevailing inadequacies. One of MSF’s co-founders, Bernard Kouchner, went on to become France’s Health Minister and later Foreign Minister. But largely lost amidst the catastrophe was the fact that the then-Nigerian military government of General Yakubu Gowon demonetised the Nigerian Pound, deliberately, as an act of war to create financial chaos in the breakaway state of Biafra. At least a million people died in that conflict.

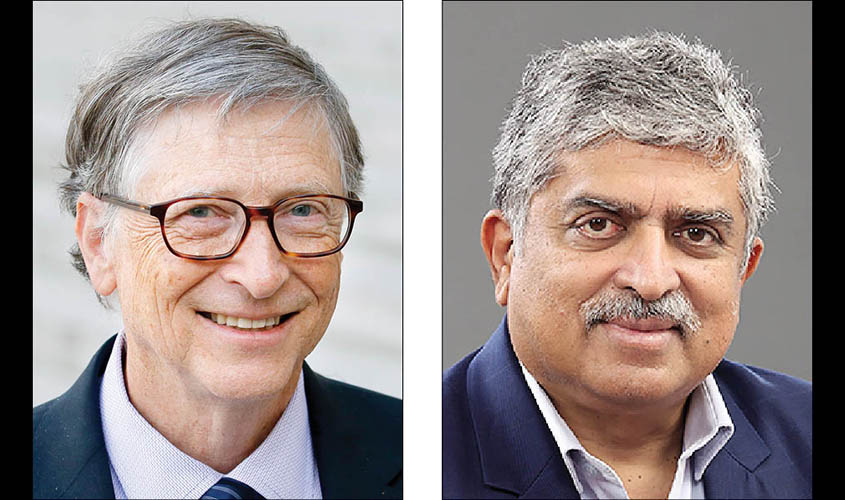

It was reported that billionaires Bill Gates and Nandan Nilekani advocated an exponential increase in cashless transaction and demonetisation to the Prime Minister’s Office (PMO). They were, in effect, not just advocating for leap-frogging but leap-kangarooing. Certain tangential ideologues had previously called for the measure, but no one took much notice of them until “Bill and Nandan” pitched in the PMO, perhaps to the PM himself as well. This was followed by approving nods from the senior-most officials in the PMO as well as the Finance & Revenue Secretaries and the Governor of the Reserve Bank of India. It is hard to imagine any PM being able to stand up against so many high officials who surround him, with almost no ministerial colleagues around in the current dispensation except for Finance Minister Arun Jaitley, himself a former Supreme Court lawyer and non-economist. None of the officials appear to have made any tangible effort to gauge the extent of power and Internet availability and smartphone accessibility at local levels (beyond relying on glowing “national” reports that are a broad average of such data), and where nights in many villages amidst power cuts within “load shedding” make it difficult to even see one’s feet—so dark it is—as I have myself experienced in multiple rural villages in four northern states. And once the extent of the tragedy that unfolded because of the completely disjointed implementation became known, no one of consequence bothered to apologise, most notably the aforementioned “Bill and Nandan”. This is a classic example of the axiom that wealth does not automatically translate into wisdom. Nevertheless, it is common for those who have acquired great wealth to see themselves as superior intellectually—as indeed a World Bank President did a few decades ago who was also a close friend of then-US President Bill Clinton and used to snarl at senior officers who disagreed with him with the comment “if you are so smart, why aren’t you rich?”

Both Bill Gates and Nandan Nilekani have taken risks to build private businesses where monthly income was unpredictable and longer-term success certainly was not assured when they started. Gates had left Harvard where he had started business activities at a time when academics in general did not comprehend the basics of entrepreneurship, and the fact that he could never return to the University is shrouded in confidentiality—all that is known is that his late mother Mary (who inspired his later philanthropy) was bitterly disappointed with those circumstances. Similarly, Nilekani and the other co-founders of Infosys were even unable to easily pay rent for their company’s first office, until later when investment and multiple contracts came into the picture amidst rising worldwide concern about the Y2K computing problem in legacy systems at the turn of the century. Infosys co-founder Narayana Murthy’s brother-in-law Desh Deshpande, who founded Sycamore Networks in the US, became wealthy beyond everyone’s imagination and likely helped in the investment process. But these days, both Bill’s and Nandan’s staff are probably those who generally have never taken risks or engaged in entrepreneurship. They are closer to corporate-bureaucrats and bureaucratic-philanthropists. Hence, it is not automatic for those staff, often hired from good universities, to be able to understand or promote genuine risk-taking entrepreneurship essential for employment of multiple millions of youth, and therefore their investment decisions remain suspect in the era when jobless growth necessitates new thinking.

The GDP growth rate or the year over the previous year growth of GDP expressed as a percentage is a broad measure of economic health. Since several studies have demonstrated a 2% drop of GDP growth attributable to demonetisation, the billionaire duo has vicarious responsibility for some $52 billion of losses of the $2.6 trillion economy in year 2016-17 alone. Multiple indicators point to demonetisation having had a devastating impact on rural and urban distress of the informal sector, migrant workers, and other disadvantaged sections, as well as entities and establishments where they try to work. Irrespective of who wins the next parliamentary election in May 2019, great remedial efforts will be required to rectify the severe and long-lasting damage to the Indian economy because of the drying up of investable capital and indeed the tremendous loss of employment as tiny, small and medium enterprises folded amidst severe cash shortages and illiquidity engendered by demonetisation.

Remedial measures are not just a matter of allocating budgets to opaque governmental systems that are ill equipped with their heavy baggage of repressive regulations, anti-growth taxes (such as the nearly-unbelievable-Angel-funding-tax) and archaic rules inherited from British colonialism to make any tectonic shift in employment. Just as young medical students who founded Médecins Sans Frontières have shown, for certain goals especially in reaching the hitherto unreached, governments are not best equipped and it is time for new mechanisms that are more sensitive to lost time and opportunity than to conformity with ageing, cumbersome staff rules. Undoubtedly, one can expect that the wealthiest people on earth, Bill and Nandan being among them, will not shirk their responsibilities towards the less fortunate.

Dr Sunil Chacko is a graduate of Harvard and Columbia Universities, served in the Executive Office of the World Bank Group and won a commendation from the then-World Bank President for his innovation. He has been an adjunct faculty member and entrepreneur in the US, Canada, Japan and India.